Murdoch ready for CNBC fight, 'Borat' sequelNews Corp. chairman and CEO discusses plans for a new business channel, MySpace, presidential politics and 'Borat.'NEW YORK (CNNMoney.com) -- In a wide-ranging speech Thursday morning, News Corp. Chairman and Chief Executive Officer Rupert Murdoch discussed plans for a new cable business channel, the growth opportunities for social networking site MySpace, the 2008 presidential race and why he liked "Borat" so much. Murdoch, speaking at McGraw-Hill's Media Summit conference in New York, told the crowd that News Corp. (Charts), which owns the Fox News Channel, will have a Fox cable business channel on the air by the fall.

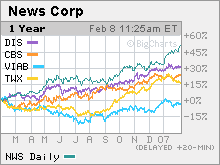

He said that, despite the fact that the cable business news segment is dominated by General Electric (Charts)-owned CNBC, he felt there was an opportunity to challenge CNBC. Murdoch said more details about the network would probably be announced next week but that he was going to keep many plans about the network under wraps for now. "We are not going to announce too much detail on programming because everything we do, CNBC will immediately copy," Murdoch quipped. News Corp.'s cable networks business has been one of the stronger performers for the company, which announced fiscal second-quarter results on Wednesday that topped analysts' expectations. Cable has also been a solid business for rival media companies Walt Disney (Charts) and Time Warner (Charts), which both reported healthy quarterly results during the past week. Time Warner owns CNNMoney.com. But News Corp. has been the best-performing media stock during the past year thanks in large part to its rapidly growing Internet business, which includes the popular social networking site MySpace, which News Corp. acquired in 2005. During his remarks, Murdoch said that MySpace has grown much faster than he and other News Corp. executives expected and confessed that managing the large gains in traffic at the site has been a challenge. But he did not seem worried about competition from the likes of Facebook, a social networking site that has become popular with college students. He stressed that many people have pages on a variety of social networking sites. "A lot of young people, college kids undoubtedly, are going to Facebook. But that doesn't mean they don't stay with MySpace," he said. Murdoch said that revenue from MySpace and other sites such as gaming news network IGN, which make up the company's Fox Interactive Media (FIM) unit, could hit $1 billion in the company's next fiscal year, which ends in June 2008. He added that sales from FIM could wind up representing as much as 10 percent of News Corp.'s total revenue within the next five years. He also dismissed concerns that Internet search leader Google (Charts), with which MySpace has an advertising partnership, is becoming more of a competitor to MySpace now that Google has acquired online video sharing site YouTube, saying that YouTube is a "hypnotic" experience but not a community site like MySpace. Although News Corp. is acknowledged as one of the most Internet-savvy of media businesses, it also has a large newspaper division as well. And the newspaper segment is facing challenges as advertisers and readers are increasingly turning to the Web for news. Murdoch conceded that the newspaper business is rapidly changing. "Newspapers are very vulnerable. We have got to be neutral about what platform we sell them on," he said. "The old lifestyle of families reading a newspaper over breakfast is gone." But Murdoch said that he had no plans to sell News Corp.'s newspaper segment. In fact, he reiterated comments that he made during the company's earnings call Wednesday about teaming up with other investors to try and buy Newsday, a Long Island newspaper owned by Tribune (Charts), the media company that is exploring a possible sale or breakup. He said he felt that combining Newsday with the News Corp.-owned New York Post would lead to greater profits for News Corp. However, he said that he was beginning to doubt that a deal would take place and stressed that he was only interested in Newsday and not other Tribune assets. Murdoch also defended his company's decision to exit the satellite television business in the United States. News Corp. recently agreed to sell its stake in DirecTV (Charts) to Liberty Media, the conglomerate run by mogul John Malone, in exchange for Liberty's stake in News Corp. Murdoch said that he still believed satellite TV was a great market for News Corp. in Europe and Asia but that competing in the United States has grown difficult since DirecTV cannot offer the bundled packages of Internet access, video and voice that cable and phone companies can. "The appeal of the triple play, and potentially the quadruple play with mobile, is tough to compete with," he said. Murdoch also expressed optimism about the growth prospects for the company's movie studio business, which had several of the biggest-grossing films in the United States last year. He said Internet piracy of movies is actually not that big of an issue right now and that the market for new releases of DVDs is better than ever. Murdoch also said he was a big fan of the controversial "Borat" film, which was released by News Corp.'s Fox studio and has grossed more than $128 million in the United States. "I've seen it about three times and laughed like hell," he said. "I don't think it destroyed our culture. If anything, it made Americans laugh at themselves." Murdoch said that the film's creator and star, British comedian Sacha Baron Cohen, has signed on to do a "Borat" sequel. Turning to politics, Murdoch defended the news coverage in his papers and on the Fox News Channel, which some believe represents an overly conservative take on politics. When asked about the presidential race in 2008, Murdoch said that Sen. Hillary Rodham Clinton (D-NY), who is widely viewed as the front-runner for the Democratic nomination, is "very intelligent" but also "very calculating" and "divisive." Taking a jab at Clinton's husband, former President Bill Clinton, Murdoch said that he did think Hillary Clinton would be stronger on defense and foreign policy than Bill Clinton. Murdoch also said that he was interested in meeting Sen. Barack Obama (D-Ill.) and that he would like to see former Speaker of the House Newt Gingrich, a Republican, run for president. But Murdoch saved his most effusive praise for Mike Bloomberg, the current mayor of New York City. Murdoch said Bloomberg would likely win many votes from the East Coast and West Coast states and called Bloomberg a "genuine public servant" who could run on a platform of "clean and efficient government." The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|