Playboy says it's not for saleThe adult entertainment company has hit a rough patch. Some on Wall Street wonder whether it's time for the Hefners to take the Playboy Bunny private.NEW YORK (CNNMoney.com) -- Sex sells. Or does it? Playboy, the company known for its flagship magazine featuring a bunny logo and centerfolds of naked women, "adult entertainment" television programming and lavish parties at founder Hugh Hefner's mansion, hasn't been much of a turn-on on for Wall Street lately.

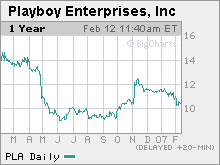

Shares of Playboy (Charts) fell nearly 18 percent in 2006 and so far this year have dropped another 7 percent. It's enough to make Playboy investors want to hide beneath one of Hefner's trademark velvet smoking jacket robes. And the stock's poor performance has some calling for Playboy to make some drastic moves, possibly even a sale of the company. According to a report from Reuters, Playboy executives said during a conference call with analysts Tuesday morning that the company has no plans to go private. Playboy released its fourth-quarter and full-year results on Tuesday and the numbers were disappointing. Revenue for the fourth quarter came in at $86.2 million, down 5 percent from a year ago, and below analysts' expectations of $93.1 million, according to estimates from Thomson First Call. Earnings came in at 11 cents per share, 20 percent lower than a year ago and below Wall Street's consensus estimates of 12 cents per share. The company's fundamentals during 2006 were hardly scintillating. Overall sales fell 2 percent to $331.1 million, and the company reported a net profit of just $2.3 million. Revenue from its domestic TV business, which accounts for more than a quarter of the company's total sales, slid 16 percent because of lower cable and satellite TV pay per view sales. The company's publishing unit, like many other magazine companies, is struggling as well as more and more readers and advertisers are flocking to the Internet. Total publishing revenues fell 9 percent in 2006, with advertising sales plummeting 14 percent. Publishing accounted for nearly 30 percent of the company's sales last year, but the division posted a net loss of $5.4 million. Michael Kelman, an analyst with Susquehanna Financial Group, said that the biggest question mark facing Playboy is its domestic TV business. He said that the company is shifting to a subscription video-on-demand strategy as opposed to individual pay per view movies. Playboy has agreements with the top two cable companies, Comcast (Charts) and Time Warner Cable, to offer the video-on-demand service. Time Warner Cable, which like CNNMoney.com is owned by Time Warner (Charts), has yet to roll out the service, though. But the problem facing Playboy, Kelman says, is that the cable companies are often reluctant to tout adult entertainment channels aggressively. "There is often little marketing support for adult content from the cable operators." Kelman adds that Playboy is facing tougher competition in video from New Frontier Media (Charts), which operates adult entertainment channels known as the Erotic Networks. The two bright spots for the company are its digital business and licensing operations, both of which are growing rapidly. Revenue from online subscriptions and e-commerce increased 11 percent last year. On Friday, Playboy announced that is creating a DVD box set that will feature all issues of the magazine in electronic format. Sales from licensing rose by 19 percent in 2006. And Playboy's licensing business should get a further boost this year thanks to last October's opening of a Playboy Club at the Palms Hotel and Casino in Las Vegas. "People have questioned the long-term ability of Playboy to survive but we think it will survive. We like the plans they have in cable and licensing and the valuation is cheap enough that not a lot has to work for the stock to rebound," said Virge Trotter, an analyst with Manning & Napier Advisors, a Fairport, NY-based money management firm that owns approximately 180,000 Playboy shares in its Manning & Napier Small Cap Series fund. But despite this, David Miller, an analyst with Sanders Morris Harris, downgraded the stock last week to a "hold" and wrote in a research note that "sound fundamentals in licensing" are "not enough to make up for tough conditions in publishing." He added that "many investors are losing patience" in the company's shift to subscription video-on-demand TV services. Because of the company's woes, some have begun to suggest that Playboy could be an attractive takeover candidate for a leveraged buyout. Mark Boyar, president of Boyar Asset Management, an institutional investment firm that owns 292,700 shares of Playboy according to FactSet Research, said after the company's last annual shareholder meeting in May that the company should consider a sale. Private investors have been circling media companies for the past year, and several prominent firms have been bought through an LBO, in which a company uses debt to finance the purchase. Radio station operator Clear Channel Communications (Charts), Spanish language broadcaster Univision (Charts) and magazine publisher Reader's Digest (Charts) have all agreed to be taken over during the past year. In fact, when CNNMoney.com wrote last November about media companies with sluggish but steady growth prospects and healthy balance sheets that could appeal to private equity firms as leveraged buyout targets, Playboy made the list along with The New York Times Company and Meredith Corp. But a big obstacle to a sale would be whether or not the Hefner family (Hugh's daughter Christie is Playboy's chief executive officer) would agree to it since the Hefners own a majority of Playboy's voting-class shares. "With regards to a leveraged buyout or management buyout, the idea's certainly kicked around when the stock is hit. But it's all up to the Hefner family since they control 70 percent of the vote," said Kelman. And Sanders Morris Harris's Miller said in an interview that he did not think the Hefners are interested in selling out. "We always find it amusing that every time operations at media companies falter compared to expectations, people who still like the stock subscribe to this notion that the company is going to be taken private," he said. "Playboy needs to be public as a way to reward employees with stock options. You can't do that when you're private. We don't really see this speculation as something to take seriously in the near-term," Miller added. Manning & Napier's Trotter is even more blunt regarding the prospects of a takeover. "I don't think a sale will happen as long as Hugh Hefner's alive," he said. This story is an update of one that appeared on February 12.

Analysts quoted in this story do not own shares of the companies mentioned, and their firms have no investment banking relationships with the companies. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|