Satellite radio chiefs defend merger, but ...Heads of Sirius and XM say deal will be good for consumers and investors - but some doubt it will be approved.NEW YORK (CNNMoney.com) -- The top executives from Sirius and XM took their first steps to reassure Wall Street Tuesday that a deal will pass muster with regulators - but investors appear to have doubts about whether the proposed merger will go through. "I'm sure the regulatory approval process is on everyone's minds. And I can assure you that both companies have done all their homework on this issue," Sirius Satellite Radio CEO Mel Karmazin said on a conference call Tuesday morning. Karmazin will be the chief executive officer of the combined company, which has yet to choose a name.

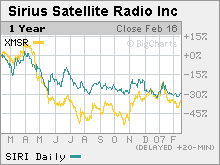

But doubts about approval by regulators appeared to be weighing on the stocks Tuesday. While shares of Sirius (up $0.24 to $3.94, Charts) jumped about 6 percent in afternoon trading and XM (up $1.79 to $15.77, Charts) surged 13 percent, both on Nasdaq, XM stock was trading below the $17.02 a share value for XM under the roughly $13 billion deal. "There could be concerns about whether or not the merger could be completed," said April Horace, an analyst with Janco Partners. "A lot of times when mergers get announced the stocks don't immediately reflect the value attached to them from the deal if there are overhangs or uncertainties." Now Sirius and XM have to convince Wall Street that their merger will get approved by the government - no easy task considering that Federal Communications Commission rules currently prohibit a combination between the two companies. FCC chairman Kevin Martin reiterated this stance in a a statement Monday afternoon following the announcement of the merger. "The hurdle here, however, would be high as the commission originally prohibited one company from holding the only two satellite radio licenses," Martin said in the statement. The marriage of Sirius and XM would bring together the nation's only two satellite radio services. Sirius, which ended last year with about 6 million subscribers, is most well-known for being the home of shock jock Howard Stern, a Martha Stewart channel and National Football League games. The larger XM, with about 7.6 million subscribers, airs the popular Opie and Anthony show and is also home for programs by Oprah Winfrey and Bob Dylan as well as Major League Baseball games. Analysts grilled Karmazin and XM chairman Gary Parsons, who will serve as the chairman of the combined company, about the chances for the merger to get approved. In addition to the FCC, the deal will also need to be approved by the Justice Department, which is expected to take a close look at whether the deal violates antitrust law. Parsons said he didn't see this as a problem though. He argued that the company's true market is not just satellite radio but all other forms of mobile entertainment, including digital music players like Apple's (Charts) iPod, cell phones that play music and free radio. "Cell phones are morphing by the moment. Car manufacturers are installing jacks for MP3 players," Parsons said. "There also has been rapid growth of HD radio and Internet radio." One antitrust lawyer in Washington who asked not to be named said that might not be enough to convince the Justice Department to approve the deal. The lawyer called the chances of regulatory approval a "long shot." "What is the scope of relevant competition? Is it limited to satellite radio or is it a lot broader than that? It will have to be a lot broader to help them," the lawyer said. Parsons said that he expects investors to approve the deal within four to six months and that the transaction could close by the end of the year. "We expect to work closely with regulatory authorities. We believe there is a solid basis for approval," Parsons said. Thomas Watts, an analyst with Cowen & Co., agreed that the deal will get approved by the end of this year but said it will be a tough battle. "Terrestrial radio will fight approval tooth and nail," he wrote in a note Tuesday morning. Jonathan Jacoby, an analyst with Banc of America Securities, wrote in a note Tuesday that based on conversations he's had with sources in Washington, chances of a deal getting approved by the first quarter of 2008 are less than 50 percent. And Greg Gorbatenko, an analyst with Jackson Securities, said he would be very surprised if the merger was green-lit by the government given the antitrust concerns. "I wouldn't believe it if this deal got through. Kevin Martin is going to try and block it. Broadcasters will try and block it. Logic should block it," he said. The company's pricing structure is expected to be a big focus of the Justice Department's review. Both companies currently charge subscribers a $12.95 a month for a variety of music, news and talk channels. Most of the music channels air commercial free but both networks have slowly started to feature more ads in a bid to boost revenues. Neither Karmazin nor Parsons would comment directly on whether the combined company would seek to raise prices but Karmazin strongly hinted that raising prices would not be the best idea. "We are competing principally with free radio. What we are trying to do is get more subscribers and not just charge the 10 percent of the population that already subscribe more money," he said. "We are reaching out to the 90 percent that are not subscribers. Obviously there is sensitivity on the price point." Karmazin added that a combined company could also do a better job of attracting interest from large national advertisers. He said that XM and Sirius combined to generate just $70 million in advertising revenue last year versus $20 billion in ad dollars for traditional AM and FM radio station owners. Speculation about a merger has run rampant on Wall Street for the past year as both stocks suffered due to concerns about subscriber growth and intense competition, prompting some analysts to suggest the two companies would be better off combining. To that end, Jackson's Gorbatenko said Sirius and XM may simply be trying to merge in order to appease large institutional investors who may be growing tired of the years of losses racked up by both companies. The antitrust lawyer said the best chance the companies had of getting the deal approved by the Justice Department would be to stress that the only way the companies could survive would be by merging. He called that a "hail Mary" move. Janco's Horace added that the emphasis on getting the merger done could actually hurt both companies even more since executives will be spending more time dealing with regulators and not as much on the fundamentals of the business. "While management focuses on getting the regulatory approval, what's going to happen to the business in the meantime? That raises some other questions for investors," she said. Analysts quoted in this story do not own shares of the companies mentioned. Banc of America has performed investment banking for Sirius and XM but the other firms mentioned in this piece do not have banking relationships with either company. |

Sponsors

|