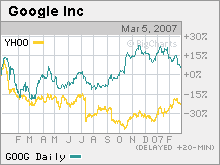

Yahoo! thumps Google on Wall StreetThanks to optimism about its new Panama search technology, Yahoo's shares are outperforming Google's this year. But how long can that last?NEW YORK (CNNMoney.com) -- Senior executives at Yahoo! have probably become big fans of the rock group Van Halen lately. Yahoo's stock is up 19 percent this year, and the online media company's recent resurgence is largely due to optimism about its new search platform, which shares the name of one of Van Halen's biggest hits from the 1980s: Panama.

So who could blame Terry Semel, Sue Decker and other Yahoo (Charts) bigwigs for singing at the top of their lungs -- ala David Lee Roth -- "Panama. Panama-a! Panama. Panama-a-a-a-a-a!" Panama, which is in the process of being rolled out to advertisers, is said to be winning raves from Yahoo customers, who are finding that the new technology is leading to more relevant and efficient targeting thanks to a better search ranking algorithm. "The early feedback on Panama is strong. Click-through rates are better than expected," said Marianne Wolk, an analyst with Susquehanna Financial Group. And as long as marketers are making more money from search ads on Yahoo, that's obviously good news for Yahoo as well. "Anecdotal evidence points to a smooth transition to Panama," said Scott Devitt, an analyst with Stifel Nicolaus & Co. "And improved monetization for Yahoo's search should add to the company's revenue and earnings." Yahoo's comeback on Wall Street is particularly noteworthy considering that its top rival, Google (Charts), has had a rough go so far in 2007. Shares of Google, which, briefly traded above $500 in January, have since pulled back to about $440, their lowest price since mid-October. Google's stock, despite a strong fourth quarter earnings report in early January, is down nearly 5 percent this year. But based on recent figures from two influential market research firms, Google continues to dominate the world of online search. According to comScore Media Networks, Google had 47.5 percent of the U.S. market share of Internet searches in January, up from 47.3 percent in December. Yahoo, meanwhile was in second with 28.1 percent market share, down from 28.5 percent in December. And according to Nielsen//NetRatings, Google's U.S. search market share was 53.7 percent in January, compared to 22.7 percent for Yahoo. The number of searches at Google increased 40.6 percent form a year ago while Yahoo searches increased 28.8 percent. "Google is gaining market share from Yahoo and second tier players like Microsoft and AOL," said Devitt. Microsoft's (Charts) MSN is the third-largest search site. AOL, which like CNNMoney.com is owned by Time Warner (Charts), is ranked fourth by Nielsen and fifth by comScore. The other top five search site is IAC's (Charts) Ask.com. And because Google hasn't exactly stumbled this year, some think that the recent sell-off is a good opportunity to buy the stock, particularly since Google is actually cheaper than Yahoo on several measures, including a price-to-earnings basis. Google trades at 31 times 2007 earnings estimates while Yahoo has a P/E of 57. "Fundamentals for Google haven't deteriorated and the valuation is pretty good as well," said Sasa Zorovic, an analyst with Oppenheimer & Co. So why has Google's stock taken a hit? Some analysts said that concerns about Google's YouTube subsidiary could be playing a role. Google bought YouTube last year for approximately $1.7 billion, but there has been some skepticism about how much revenue YouTube will be able to generate from online video advertising. In addition, several big media companies have been cracking down on YouTube lately. For example, Viacom (Charts), which owns cable networks MTV, Comedy Central and Nickelodeon, demanded last month that YouTube take down copyrighted videos from Viacom-owned networks that were posted on YouTube without Viacom's permission. "Investors are looking for signs that Google is going to make a huge success out of YouTube. They need to work on copyright protection. Online video is the next major growth engine we're looking for from the company," said Wolk. Devitt agreed that YouTube's battle with big media could be weighing on the stock for the short-term, but that long-term investors should not be overly concerned with the copyright issues. "Stocks move on sentiment so sure, YouTube's difficulties can have an impact," he said. "But in the big scheme of things for Google, YouTube's not that significant. Video advertising will make its way into the mainstream on the Internet but it's a slow process. I'm comfortable that YouTube was a rational investment." Another analyst added that the recent price movements in Yahoo and Google are simply a reaction to what happened last year. There was a lot of doom and gloom about Yahoo's future in 2006, when the company delayed the launch of Panama and warned in September that third-quarter sales would be at the low end of forecasts. As such, Yahoo's stock plunged more than 35 percent last year. Google, on the other hand, kept blowing away analysts' earnings estimates, gaining market share in search and then capped off the year by buying YouTube, a move that most analysts praised as a strategy that would boost Google's presence in the hot social networking area. The stock gained 11 percent in 2006. But when Google reported fourth-quarter numbers in January, it only beat estimates by 9 percent, a smaller amount than it had beat in prior quarters. "With Yahoo, you had a case of a stock that overshot to the downside. A lot of it is just momentum in nature," said Tim Boyd, an analyst with Caris & Co. "With Google, expectations were so incredibly high. They had another great quarter but because it wasn't a blowout you had a lot of profit taking. But I think it's healthy. You don't want to see stock go up, up and up and never take a breather." The important thing for many investors to remember, though, says Oppenheimer's Zorovic, is that there is no reason why Google and Yahoo can't trade in tandem. Both stocks could go up as long as the market for online advertising remains strong - or both could go down if demand suddenly dampens. Of course, that's the big wild card. It remains to be seen how well online advertising will hold up in the face of a prolonged economic slump. But Zorovic said that even if the economy cools and overall advertising spending slips, more and more marketers will realize that they can get a better return on their investment from Internet search ads than they would from print, radio, TV or other traditional media. "When the economy suffers, advertising suffers. It always does," Zorovic said. "However, online advertising can still grow as people shift more of their marketing dollars from offline to online." Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking ties with the companies. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. |

Sponsors

|