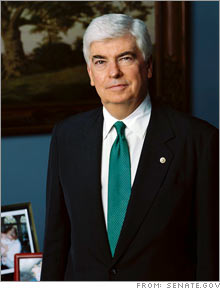

Senator faults regulators in subprime messSen. Dodd says regulators have failed to protect consumers from the hemorrhaging in the subprime mortgage market.NEW YORK (CNNMoney.com) -- Connecticut Democratic Sen. Christopher Dodd said Monday that federal regulators have been "asleep at the switch" and must start exercising their authority to stop the hemorrhaging of the subprime mortgage market. The chairman of the Senate Banking Committee told CNNMoney.com that he did not believe new, restrictive regulation was necessary, but rather there was "enough on the books" already to protect consumers defaulting on their loans and losing their homes.

Dodd, a presidential hopeful, admitted that he did not know what sort of bailouts were realistic for as many as 2.2 million subprime borrowers at risk of default, but said that "we need answers very quickly." To that end, he said he planned to meet soon with Wall Street banks that buy the loans from mortgage lenders and repackage them into securities, as well as others, in order to come up with some solutions. (See correction). His goal, he said, is not to deny low-income people access to capital or scare investors away from the subprime market altogether, but rather to find some way to help consumers meet their mortgage obligations. The subprime market is the riskiest segment of the U.S. mortgage market and serves borrowers with poor credit histories. It has seen rising default rates in recent months amid falling prices and slower sales in the housing market. Most subprime loans are so-called 2/28 (or 3/27) loans, meaning that the first couple of years of payments are at the low "teaser" rate. After that, the loans reset every six months or year to a higher, fully indexed rate, which can cost borrowers hundreds of extra dollars each month and make meeting payments difficult if not impossible. In 2006, these loans accounted for 20 percent of all mortgages, up from 5 percent in 2001, according to trade publication Inside Mortgage Finance. (Correction: An earlier version of this story referred to mortgage-backed securities as equities. CNNMoney.com regrets the error. Back to story). Subprime risk: Most vulnerable markets |

|