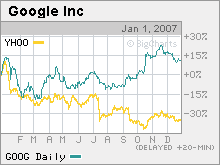

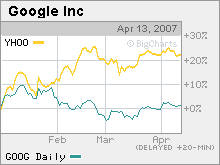

A tale of two search enginesFor Wall Street, it's the best of times for Yahoo! and the worst of times for Google. Not so fast.NEW YORK (CNNMoney.com) -- Momentum. Yahoo! has it. Google doesn't. That's the current view on Wall Street. Shares of Yahoo (Charts), the number two search engine, have surged 22 percent this year while shares of Google (Charts), the top dog in search, are up just 1.5 percent.

But with both companies due to report earnings in the next few days, some analysts think the momentum could swing back to Google. Google's $3.1 billion acquisition of digital advertising services leader DoubleClick, announced late Friday, also could give Google a boost in its efforts against Yahoo. The increase in Yahoo's stock is largely due to optimism about the company's new search tool, called Project Panama. The consensus among many followers of the search advertising industry is that Panama, which is in the process of being rolled-out to advertisers, is leading to more relevant search results on Yahoo and that, in turn, should generate more revenue-per-search, and eventually, increased market share. But despite Yahoo's technological improvements, Google still dominates search. According to the most recent figures from Internet research firm Hitwise, Google accounted for 64 percent of all searches in the U.S. in March, compared to just 21 percent for Yahoo. Third place MSN, owned by Microsoft (Charts), had 9 percent of the market while IAC (Charts)-owned Ask.com had just 3.5 percent. What's more, Google was the only company among the top four search engines to gain market share compared to both February and March of last year. "It will take a long time for Yahoo to chip away at Google's lead in search," said Clayton Moran, an analyst with research firm Stanford Group. Analysts also said it will probably be too soon to see a tangible impact from Panama on Yahoo's first-quarter results. To that end, when Yahoo reports Tuesday, analysts expect it to post revenue excluding sales shared with ad partners of $1.2 billion, up 11 percent from a year ago. Earnings are seen at 11 cents a share, flat with last year. Google, on the other hand, is expected to report much stronger results. Wall Street is expecting revenue excluding shared ad dollars of $2.5 billion, a 63 percent increase from last year, and earnings of $3.30 a share, up 44 percent from a year earlier. "When investors see Google's numbers, people will realize that this company is dominant in what is still a large growth industry," said Steve Weinstein, an analyst with Pacific Crest Securities. So why has Google's stock been so sluggish lately? Brian Bolan, an analyst with Jackson Securities, said there appears to be a bit of a so-called paired trade situation going on with the two stocks. By that, he means that some institutional investors may be short-selling Google (betting the stock will go down) while going long Yahoo. This is a reverse of what happened last year when Google enjoyed a nice run up while Yahoo's stock plunged 35 percent. So some investors may believe that Yahoo was due for a bounce since it was such a poor performer last year due to concerns about delays in Panama. And Weinstein said Google's lack of financial guidance may be hindering the stock. He argues that it's tougher for investors to figure out exactly where new growth will come from since the company is pretty tight-lipped about its strategy. As such, he thinks investors may be focusing more on some of Google's high profile problems, such as the $1 billion copyright infringement lawsuit filed against it and its online video subsidiary YouTube by media company Viacom (Charts). The lawsuit, coupled with a subsequent announcement by News Corp (Charts). and GE's (Charts) NBC Universal of their own online video venture to compete with YouTube, has some on Wall Street wondering whether YouTube was worth $1.6 billion for Google. YouTube's just a small slice of Google's revenue stream so far. "Because you don't have a lot of clarity from Google, things that you might brush off might get magnified and the doubt and uncertainty is higher," Weinstein said. Yahoo, on the other hand, is being increasingly viewed by Wall Street as a company that has a concrete plan and is not shy about talking it. Company executives have been very vocal about how excited they are about Panama and what it will mean for Yahoo. And Yahoo landed a key partnership deal with Viacom this week. Viacom said it would use Yahoo's new Panama system to power sponsored search and contextual ads on 33 of its broadband sites, including MTV.com, BET.com and Nickelodeon.com. So even though most analysts don't expect Panama to boost sales and profits until the second quarter at the earliest, there's still a greater sense of excitement about Yahoo. "Yahoo's earnings report will probably be more eventful because of the introduction of Panama. Everything Yahoo has said indicates that it's doing a great job with Panama," Stanford Group's Moran said. "So we could see some optimistic guidance from the company." Nonetheless, analysts said Google might now be the better bet for investors given that Yahoo has run up so dramatically. For one, Google's growth prospects for the next few years still outpace Yahoo's. According to estimates from Thomson Financial, analysts are forecasting an annual earnings increase of 32.5 percent, on average, for the next few years, compared to yearly projected growth of 22 percent for Yahoo. Despite that, Yahoo is valued at a higher price-to-earnings ratio than Google -- Yahoo trades at 58 times 2007 earnings forecasts while Google's trading at 33 times this year's estimated profit. Of course, given how relatively pricey both stocks are, analysts think both companies could be vulnerable to a pullback unless they beat, as opposed to just meet, first-quarter estimates. With all that in mind, Bolan at Jackson Securities said Google is more of a sure thing. Google has a more consistent history than Yahoo of beating the Street's expectations. Plus, Bolan adds, there still are some questions about how much of a financial lift Panama will give Yahoo while there are no doubts about how successful Google's search business is. "Google is the better opportunity. It's more of a sound investment," Bolan said. "With Google you know that things are working while with Yahoo you are hoping that things will work," he said. Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking ties with the companies. |

Sponsors

|