Good news for newspaper stocks?Yes, newspapers are getting beaten up by the Internet. But with long-term investors showing interest, is it time to look past the bad headlines and buy?NEW YORK (CNNMoney.com) -- "Newspaper: a paper that is printed and distributed usually daily or weekly and that contains news, articles of opinion, features, and advertising." That's the definition of newspaper according to Merriam-Webster. Although some on Wall Street probably wonder if the word "advertising" should be removed in order to make it more accurate.

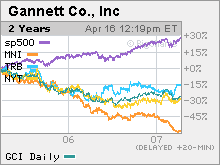

Several big newspaper companies are scheduled to report their first-quarter results this week and the numbers are unlikely to be very good. Gannett (Charts), The New York Times (Charts), Journal Register (Charts) and Tribune (Charts) (which is in the process of being taken private by real estate mogul Sam Zell), are all expected to post year-over-year declines in both revenue and earnings for the first quarter. It's no secret that newspapers are struggling. Circulation and ad sales are down for many publishers as readers and marketers increasingly flock to the Web. But could all the bad news, so to speak, already be priced into the shares of the big publishers? Edward Atorino, an analyst with Benchmark Company, a research firm based in New York, points out that most investors realize the first-quarter results will be weak. Plus, analysts have already lowered their first-quarter profit forecasts for most of the newspaper companies. So as long as the publishers don't further disappoint Wall Street by posting worse-than-expected results, the stocks could soon start heading higher. "The environment for the newspaper industry is pretty bad, but the stocks may have stabilized," he said. Larry Grimes, president of W.B. Grimes, an investment bank based in Gaithersburg, Md., that focuses on media mergers, adds that pressure from institutional shareholders to boost returns could also force companies to make moves that could increase profitability. To that end, Gannett, which publishes USA Today, announced last week that it was selling four of its daily newspapers in smaller markets to Gatehouse Media for $410 million. "All of the publicly traded newspaper companies are under fire from their institutional investors. They are all under the microscope right now," said Grimes. "Gannett just sold four papers to Gatehouse and that deal probably would not have been done only a year ago." It's also worth noting that several well-known money management firms have been boosting their stakes in newspaper publishers as of late. According to figures from FactSet Research, which tracks institutional holdings, T. Rowe Price, BlackRock and George Soros' investment firm increased their position in Gannett during the fourth quarter of last year, while Fidelity and Vanguard bought more shares of McClatchy (Charts). Atorino argues that some of these investors are probably focusing more on the long-term prospects of the newspaper business. He said that despite tough times now, many publishers have taken steps to ally themselves with the two top search firms, Google (Charts) and Yahoo! (Charts), in order to increase their exposure online. As such, McClatchy announced Monday that it was joining a consortium of 11 other newspaper publishers that will use Yahoo's paid search results on their papers' Web sites. "People with a longer term horizon may think that with the stocks trading near historic lows, they are a good value. I think that they believe expansion online, (including) deals with Google and Yahoo, will be a key to new growth," Atorino said. Still, Grimes points out that it's going to take a while before the major publishers are able to generate enough revenue from the Internet to offset the weakness in their core business. "All publishers are going to report significantly higher online revenues but when one examines the total dollars involved it doesn't make up for the declines in print," he said. Both Grimes and Atorino also said investors shouldn't get their hopes up about more consolidation in the industry either. Atorino said he viewed the Tribune deal as a one-time event and not a sign of more deals to come. He points out that there already have been several newspaper mergers in the past few years. Grimes said that Journal Register and Lee Enterprises, which bought rival Pulitzer in 2005, could be takeover targets. But he said that even if more newspaper publishers agree to sell out, they probably aren't going to be able to fetch a significant premium. After all, Tribune agreed to sell to Zell for $34 a share, only 6 percent higher than the stock's closing price before the transaction was announced. "Private equity deals are not going to be attractive for sellers," Grimes said. Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking ties with the companies. |

Sponsors

|