Yahoo disappointsWorld's second-largest online search company reports first-quarter results that miss estimates; stock sinksNEW YORK (CNNMoney.com) -- Yahoo!, the world's second-largest online search company, announced a decline in first quarter profit Tuesday, results that missed Wall Street's forecasts and a setback following a bullish run for the stock earlier this year. Some analysts had hoped that Yahoo's new search platform for advertisers, called Project Panama, would help to generate more revenue and profit for the company and make Yahoo a tougher competitor to top rival and search leader Google.

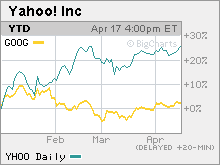

Shares of Yahoo (Charts) fell nearly 8 percent after hours following a 1.5 percent gain in regular trading on Nasdaq. Yahoo reported revenue of $1.67 billion, up 7 percent from a year earlier. Excluding sales that Yahoo shares with partners, Yahoo posted revenue of $1.18 billion, lower than Wall Street's consensus estimates of $1.21 billion. The Sunnyvale, Calif.-based company reported net income of $142 million, or 10 cents a share, down 11 percent from a year earlier and below analysts' forecasts of 11 cents a share. "The expectations were very high for Yahoo," said Denise Garcia, an analyst with A.G. Edwards. "The whisper on the Street was that the company could potentially beat estimates by as much as 13 percent." Shares of Yahoo have surged more than 25 percent this year thanks to optimism about Panama, an upgrade to Yahoo's search technology that Yahoo claims will lead to more relevant results for advertisers and consumers. Yahoo began rolling out Panama during the first quarter following a delay in implementing the service last year. Yahoo's stock has outpaced the performance of Google (Charts) as well as Microsoft (Charts), which owns third place search outfit MSN, IAC (Charts), the parent of Ask.com and Time Warner (Charts), which owns AOL as well as CNNMoney.com. Yahoo has also signed key advertising deals with new partners in the past few weeks, including media conglomerate Viacom (Charts) and newspaper publisher McClatchy (Charts). So Garcia thinks Yahoo may be a victim of too much hype about Panama. "We heard a lot about Panama this year and how excited Yahoo was, so they may have gotten the Street a little overly excited with Panama," she said. But according to figures from Web research firm comScore that were released Tuesday afternoon, Yahoo continues to trail Google in search by a wide margin. comScore reported that Google had market share of 48.3 percent in March compared to 27.5 percent for Yahoo. In fact, Yahoo's market share slipped from 28.1 percent in February and the company was the only one among the top five search providers to report a monthly decline in market share, according to comScore. Google will report its first-quarter results Thursday and analysts expect a stronger quarter, with sales forecast to increase 63 percent from the same period last year. Google also recently announced a deal to buy DoubleClick, an online advertising firm that specializes in placing banners and other so-called display ads. Some analysts think this purchase will further increase Google's lead in the online advertising business. Despite Yahoo's disappointing first-quarter results, Yahoo's management gave an upbeat report about the company's strategy and Panama. During a conference call with analysts, Yahoo chairman and CEO said that the company planned to finish rolling out Panama to international markets in the coming months. "We continued to make good progress against the goals we outlined for the company last year and as a result, delivered a solid financial performance for the first quarter," Semel added in a statement. During the conference call, Semel added that "there is much more to do" but that Yahoo hoped to gain more ground in search as well as other rapidly growing areas such as social networking and online video. Yahoo has been criticized by some for not being as aggressive as Google and other media firms such as News Corp. in social networking and online video. Google bought YouTube last year while News Corp. purchased social networking site MySpace in 2005. But Semel touted the company's existing social networking sites, including photo sharing site Flickr and Yahoo! Answers. He also announced that the company expanded its partnership with online auction company eBay and is rolling out a new feature that links eBay's PayPal payment service to search results. Semel added during the call, when asked about Google's purchase of DoubleClick, that he felt competition would be good and that the deal validated Yahoo's strategy in the display market, where Yahoo is considered to be the leader. Acting chief financial officer Susan Decker, who is also in charge of a new unit that works directly with Yahoo's advertising partners, added in the statement that Yahoo is "very excited about the transformational changes taking place on the Internet, creating greater opportunities for both users and marketers." But some investors may want to see more tangible results and, so far, Yahoo has yet to deliver. "There's nothing in the quarter that suggested that there were any improvements," said Scott Devitt, an analyst with Stifel Nicolaus & Co. "The hype about Panama has been all anecdotal so far. If you believe in the wisdom of crowds, you would have to think there would be some real evidence of improvement in search, but it hasn't shown up yet." Drilling deeper into the numbers, Yahoo reported strong sales growth internationally, with revenue from outside the U.S. increasing 22 percent. But revenue in the U.S. was flat when compared to a year ago and operating income before depreciation, amortization and stock-based compensation expense was down 2 percent. Yahoo's marketing services revenue, i.e. sales from advertising, increased 6 percent from a year ago while sales from fees increased 9 percent. Devitt pointed out that the growth in fees was less than he had hoped for, especially when you consider that Yahoo reported that the number of fee paying customers increased by 24 percent. The company also announced that sales, excluding revenue shared with partners, for the second quarter would be in a range of $1.2 billion to $1.3 billion. The midpoint of that range is slightly below Wall Street's consensus projection of $1.28 billion. What's more, Yahoo left its sales target for 2007 unchanged from the guidance it gave Wall Street in January. The company is calling for annual revenue to be in a range of $4.95 billion to $5.45 billion, excluding the sales shared with partners. Analysts are expecting sales of $5.33 billion. During the conference call, Decker said Yahoo was looking to weed out some affiliates in its network that were not performing well, but that the benefits from these changes should not positively impact Yahoo's financial results until 2008. Semel added that the company was continuing to look for an executive to replace Decker as the permanent CFO, and was also looking for someone to fill a new position that would be in charge of all of Yahoo's consumer initiatives. The reporter of this story owns shares of Time Warner through his company's 401(k) plan. Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking relationships with the companies. |

Sponsors

|