Dialing into your cell phone with adsWith Microsoft and AOL diving into the mobile-ad business, get ready for a barrage of commercials on your mobile phone. Business 2.0's Michal Lev-Ram reports.(Business 2.0 Magazine) -- Advertisements are everywhere: websites, television and videogames, not to mention coffee coasters, airplane seatback covers, and even umbrellas. If you think that's overload, brace yourself: Things are about to get worse -- and you'll have AOL, Google (Charts, Fortune 500), and Yahoo (Charts, Fortune 500) to blame when they do.

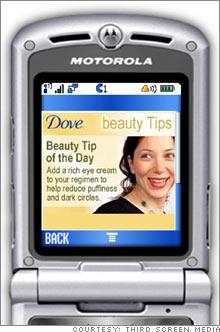

Soon, ads on your mobile phone will be as commonplace as Web pop-up ads were in their heyday. Your cell phone's three-inch screen has been hyped as the billboard of the future since the late '90s. What's changed is that it's no longer just startups trying to push the market forward. In recent weeks, online giants like AOL and Microsoft (Charts, Fortune 500) have snapped up some of those same startups, and Google and Yahoo have joined the mobile-ad race by building their own solutions. Earlier this month, AOL announced it had acquired mobile-ad startup Third Screen Media (no relation to this column, but welcome to the family, chums -- and hey, nice name). Third Screen, founded three years ago and based in Boston, provides an ad network for publishers and advertisers. Among its customers are USA Today, ESPN (Charts, Fortune 500), and Unilever. AOL did not disclose the purchase price, but plans to fold the startup into its Advertising.com ad network. Like AOL, Business 2.0 and CNNMoney are owned by Time Warner (Charts, Fortune 500). "We see this as a milestone for the industry," says Jeff Janer, chief marketing officer of Third Screen Media. "The traditional marketplace [for online ads] is now starting to consider mobile as well as the Internet." Also this month, Microsoft snatched up French mobile ad firm ScreenTonic. Google, meanwhile, is scaling up a long-running test of mobile search ads while Yahoo is rumored to be eyeing several startups, and has also launched its own mobile display-ads in 19 countries, including the United States. For those not yet in the game, there are still plenty of mobile-ad startups available. Millennial Media, a Baltimore startup, focuses on reaching young wireless users; AdMob, based in San Mateo, Calif., runs an online mobile ad marketplace; and Greystripe, a San Francisco-based specialist in placing ads inside cell-phone games, just raised nearly $9 million in venture capital. As cell phones get better at surfing websites, one-stop shops for online and mobile ads increasingly make sense. Carriers, meanwhile, are more likely to do business with the likes of AOL and Yahoo than with a startup. "At this point, it's not going to be just Third Screen Media going to talk to Verizon (Charts, Fortune 500), it's AOL," says Janer. "Now you're going to have two titans sitting at the table." That's one reason analysts are increasingly bullish on the mobile ad market. Market research firm eMarketer says American ad agencies spent $421 million on mobile advertising in 2006, a figure that's set to jump more than tenfold to nearly $5 billion by 2011. Despite the optimism, mobile ads still have a relatively low reach, particularly in the United States. That's because the majority of Americans have yet to adopt data services -- text-messaging, video, mobile Web browsing, and other applications that lend themselves to advertising. That's also why most consumers are looking forward to mobile ads about as much as they look forward to their annual dental checkup. Mobile users still tend to think of text-message spam when they hear about advertising on their cell phone, not Web-like banner ads and TV-like video ads. "As time progresses and people consider browsing on the mobile Web more and more, they will likely be much more open to ads than they are to text-messaging spam," says Eric Eller, senior VP of products and marketing at Millennial Media. One thing that could help consumers warm up to mobile ads will be the emergence of free, ad-funded content. Today, most add-on services like cell-phone video require an extra subscription fee. "The big tidal wave of mobile ad dollars has yet to happen," says Millennial Media's Eller. But, he adds, a move toward more ad-funded services is inevitable. Whether consumers like it or not, one thing is clear: Now that AOL, Microsoft and their chief rivals are investing heavily in mobile ads, it won't be long before the now-nascent market takes off. Let's just hope mobile ads aren't as obnoxious as pop-ups. Michal Lev-Ram, a staff writer at Business 2.0, covers the mobile phone industry on her Third Screenblog. To send a letter to the editor about this story, click here. |

Sponsors

|