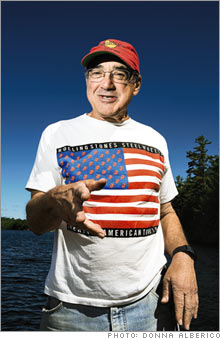

Handicapping housing's recoveryFortune's Jon Birger asks Toll Brothers CEO Bob Toll for his take on the direction of the housing market, buyers' incentives and private equity buyouts.(Fortune magazine) -- The last time Fortune checked in with Bob Toll, founder and CEO of luxury-home builder Toll Brothers, was in April 2005, when we dubbed him the "new king of the real estate boom." The moniker seemed apt: Toll Brothers was reaping record profits, and the company's stock chart looked like Cisco's in the late 1990s, with shares soaring 470 percent in less than three years. Needless to say, much has changed since then. The homebuilding industry is mired in a slump - sales of single-family homes dropped 16 percent in May, hitting their lowest levels since 2001, and the stock prices of Toll Brothers (Charts, Fortune 500) and most other homebuilders have been halved (citing a glut, competitor KB Home (Charts, Fortune 500) saw quarterly revenue fall 36 percent last month). Fortune senior writer Jon Birger recently spoke with Toll about housing's uncertain outlook.

How bad is it out there? I don't see the market getting better until, at the earliest, April of 2008. But I do think that when a recovery occurs, it will be much quicker than it has in the past because of pent-up demand. You've got decent job growth, low unemployment, low interest rates, great corporate earnings reports and tons of money being created and sloshing around the world. Weren't you worried about speculation in Florida and elsewhere during the boom? There wasn't anything we could do about it. We would make people sign in triplicate swearing up and down that they weren't speculators, but we couldn't control whom the builder next door was selling to. And when the market goes south even slightly, the investor-speculator says, "It's time to cash these things in." Some analysts think new-home prices would have fallen even further if not for all the incentives - high-end kitchens and the like - that builders are offering. When you start selling homes for $400,000 that were $500,000, all the homeowners who paid $500,000 are going to be in your sales office complaining, saying, "Why are you doing this to me? Why don't you just put a sign on my lawn saying, 'I'm a schmuck?' " So you've got to give incentives instead of lowering prices because you don't want to be rude, crude and barbaric to your clients. There's been a lot of speculation that with homebuilder stocks down so much, they might be takeover targets for private-equity funds. Do you see that happening? I think that every builder has been approached and had conversations, but obviously they haven't gone anywhere. Say an LBO fund approaches a builder, saying, "Look, your stock was $50, it's now $25. I'll give you $30." Well, why should I sell for $30 when every time the market has come back we've gone to new highs? I'm better off just battling through this and making it back the old-fashioned way - by earning it. |

Sponsors

|