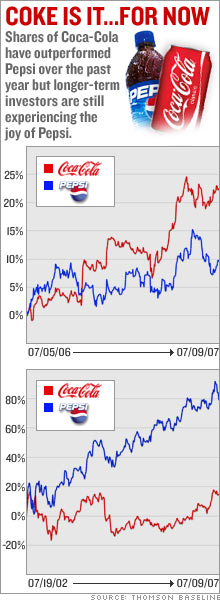

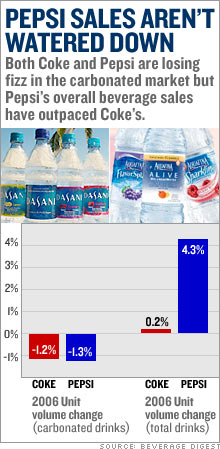

Getting the pop back in Coke stockStock Spotlight: Coke has outperformed Pepsi for well over a year. Could the revitalized beverage giant add some fizz to your portfolio?NEW YORK (CNNMoney.com) -- For the first time in a long time, Coca-Cola is proving to consumers - and investors - that it's worthy of its status as leader of the nation's $105 billion soft drink industry. Experts credit CEO Neville Isdell, who took the helm in 2004, with rejuvenating the world's largest beverage maker and transforming it from a risk-averse, complacent company into a more aggressive, innovative outfit reminiscent of the old Coke (Charts, Fortune 500).   As more health-conscious Americans shun sugary sodas, Coke, like rival Pepsi (Charts, Fortune 500), is bulking up in the profitable and fast-growing bottled tea, water and energy drink market - but it still trails Pepsi in the non-soda market. Atlanta-based Coke shelled out big bucks for key acquisitions including its recent $4 billion purchase of Glaceau, which makes Vitaminenergy and Smartwater. Isdell reportedly is also eyeing flavored tea maker Snapple. Moreover, Coke this year launched a vitamin-fortified cola drink called "Diet Coke Plus" that will soon compete with Pepsi's new vitamin-enhanced fizzy drink "Tava," due out this fall. Wall Street likes the new proactive Coke. Coke shares are up 9 percent year-to-date, outperforming the 5.9 percent gain in shares of Pepsi. And when Coke reports second-quarter results next week, Wall Street expects sales growth of 13 percent, to about $7.3 billion, while earnings are forecast to grow 10 percent to 82 cents a share, according to a survey of industry analysts by First Call. Still, given that the company's shares are within striking distance of their 52-week high, is it too late for investors to quench their thirst on Coke or does the stock still promise more growth ahead? Less fizz, more money in water Morningstar analyst Matthew Reilly estimates that non-carbonated drinks like bottled water, juice, tea and sports drinks will eventually overtake soda sales and dominate profit and volume growth in the $105 billion U.S. beverage market. In 2006, domestic sales of non-carbonated drinks jumped 13.2 percent versus a 0.6 percent decline in soda sales. Reilly applauds recent moves by Coke to increase its presence in the non-carbonated market. "Glaceau strengthens Coke's North American product portfolio which is overly dependent on sales of carbonated soft drinks," Reilly wrote in a recent report. "This acquisition also benefits Coke's current management team because it helps solidify the idea that the overly risk-averse, cost-cutting, blind-to-non-carbonated-growth days are long over." Although current management is responding to the shift in consumption trends, Coke still has a lot of ground to cover before it catches up to Pepsi in non-fizzy drinks. According to trade publication Beverage Digest, Pepsi owns 50.2 percent of the non-carbonated beverage market in the United States with brands like Aquafina, Gatorade, Lipton, SoBe and Tropicana. Coke's 23.2 percent market share includes such brands as Powerade, Nestea, Minute Maid, Enviga and Dasani. Beverage Digest editor John Sicher said the Glaceau acquisition would add 3 percentage points to Coke's total market share in the non-carb arena, however. Still plenty of cola drinkers To be sure, the biggest challenge facing both Coke and Pepsi is slowing fizzy drink sales in the United States. In 2006, both companies gave up cola market share for the second consecutive year, led by weak sales of Coke Classic and regular Pepsi, according to Beverage Digest. Coke saw its domestic cola market share dip to 42.9 percent last year from 43.1 percent in 2005. Pepsi's share fell to 31.2 percent from 31.4 percent a year earlier. Coke shipments of cases of carbonated drinks sank 3 percent in the first quarter, prompting Isdell to warn that the company would see more softness in cola sales this year before any potential pickup generated by new products. What's more, Isdell said consumers will suffer from "sticker shock" in the months ahead as Coke raises soda prices to offset higher commodity costs for things like corn syrup, a sweetener, and aluminum, for cans. This scenario is problematic for Coke since carbonated drink sales, as measured by cases shipped, accounts for 56 percent of its total volume. So, even though Coke is doing the right thing by bolstering its non-cola offerings, Sicher at Beverage Digest cautions that it shouldn't be at the expense of its carbonated drinks business. "The carbonated soft drinks business isn't growing at this point in time. But it's a folly to assume that the trend is permanent," Sicher said. "Coke and Pepsi should continue to seek a balance between focusing on their core brands and a modest pace of innovation." To that end, analysts say Coke has been successful with new cola products, including Coke "Zero," a calorie-free product launched in 2005. The company expects "Diet Coke Plus," flavor extensions of Coke Zero, energy soda beverages like "Vault Red Blitz" and ready-to-drink coffee drinks to pump up U.S. sales in the second-half of the year. Plus international markets are another lucrative growth engine. In the first quarter, volume for all beverages in Coke's overseas operations increased 9 percent, led by double-digit increases in emerging markets such as China, Russia, South Africa and eastern Europe. Should investors buy into Coke's side of life? So with all this in mind, should investors add some fizz to their portfolios? Despite this year's run-up, Coke's shares are still slightly cheaper than Pepsi's relative to earnings. Coke stock trades at 10.8 times analysts' earnings estimates for this fiscal year versus 11.3 times for Pepsi. Coke profits are expected to grow 9 percent a year over the next five years, in line with the beverage industry average, but slightly behind the forecast of 11 percent annual growth for Pepsi over the same period. But one analyst said Coke's long-term earnings growth could surpass Wall Street's expectations. "Our conviction that the company will be able to deliver more sustainable and profitable growth in the future has increased," wrote Citigroup analyst Bonnie Herzog in a recent research note. "We believe that Coke's new risk-taking strategy warrants a higher earnings growth rate than in the past and that Coke will exceed its own long-term [earnings-per-share] target of high single-digit growth." For that reason, Herzog last month upgraded Coke to "buy" from "hold" and boosted her price target by $9 to $59, about 13.5 percent above the stock's current price. That said, if Coke stays the course with product innovations and more strategic acquisitions, that could boost growth enough to help the stock rally further and outperform Pepsi into next year. Analysts quoted in this story do not personally own shares of Coca-Cola and their companies. Citigroup seeks an investment banking relationship with companies covered by its analysts. |

|