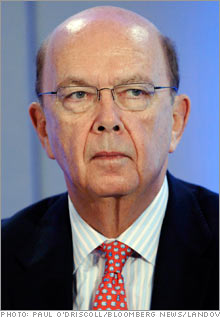

Wilbur Ross: Watch the Chrysler dealThe turnaround expert talks about the rise of private markets, credit concerns and why he's keeping an eye on the Chrysler buyout.LONDON (CNNMoney.com) -- Private equity firms have become the titans of Wall Street but the industry that built its reputation on nimble deal making is being put to the test. Financing for deals has become tougher as worries ripple through the credit markets, and investor enthusiasm for at least one newly public buyout firm, Blackstone (Charts), appears to be on the wane.

For the latest view on the market, CNNMoney.com spoke with Wilbur Ross, the turnaround expert who most recently has been placing bets on the auto parts business. In a phone interview, the buyout veteran discussed the new routes private equity is taking to raise capital as well as why he's closely watching the buyout of Chrysler by Cerberus Capital Management. CNNMoney.com: We're seeing more firms like Apollo and OakTree Capital choosing to list their shares on a new private exchange run by Goldman. What's behind the rise in private markets? Ross: I think it's a relatively new innovation that Goldman Sachs came up with. It's a kind of marketplace for sophisticated investors and it seems to be attracting some attention. Q: Why are private equity firms finding such listings attractive compared to public listings? A: Well they're doing both - Blackstone had a public listing. But public offerings take longer and require much more involvement. There's a bit more disclosure. There are a variety of reasons. Private equity in general tries to explore all avenues for capital raising and this is simply another iteration of that. Q: If you had not joined up with Invesco last year, would such a private share placement have been attractive to you? (Ross sold his company to British investment firm Amvescap, now known as Invesco, last year for $375 million.) A: Well that's a hypothetical so it's really hard to answer that. I think you'll see more [private share placements] and not just for private equity funds. This trading platform that Goldman has established is not only available to private equity firms but could potentially be [attractive to] other kinds of businesses. Q: Do you think exchanges like the new Goldman one will pose a serious threat to traditional exchanges? A: It's inherently limited. [Private markets] aren't as liquid as the regular exchanges and are confined to large-scale institutional investors as opposed to accommodating smaller public investors, so it's a very different kind of market. Q: What's your view on conditions in the buyout market? Are credit concerns a big problem? A: In the last week or so there's been market indigestion over a couple of deals, most notably the Chrysler financing. As I understand it most people feel it was a bit of spillover from concerns about the subprime mortgage market. The real question is how widespread will the contagion become, how long will it last? We're in the early days of it now and clearly it has been taking a toll on other kinds of leveraged financing. Q: How do you think uncertainty in the debt markets will affect some of the big deals? A: The test cases are the ones that are in process, like the Chrysler deal. When we see the eventual outcome of that, it will be a very good indicator. Q: What is the deal landscape like right now? A: The market seems to be at an all-time high. Deals on the one hand are more expensive, but on the other hand more things tend to be on sale when prices are high. We're in a high-price environment but with an extraordinarily large amount of volume. Those are the main characteristics of the market right now. |

|