Search News

The Small Business Administration reopened its Recovery Loan Queue this week to allocate the last of its remaining stimulus funds for lending incentives.

The Small Business Administration reopened its Recovery Loan Queue this week to allocate the last of its remaining stimulus funds for lending incentives.NEW YORK (CNNMoney.com) -- A stimulus program aimed at boosting small business lending is so popular that it has run out of funds -- for the second time.

The Small Business Administration landed $375 million last year in Recovery Act money to temporarily reduce fees and increase the guarantees banks receive on loans made through the agency's lending programs. That money ran out just before Thanksgiving.

Congress appropriated another $125 million in December to extend the incentives through February. The SBA warned lenders late last week that the remaining cash is about to run dry, and could be used up by Monday.

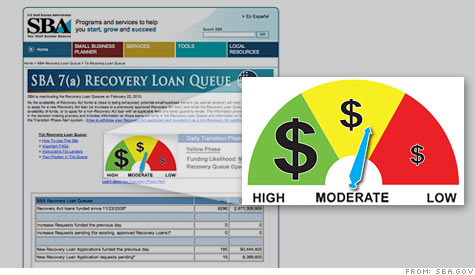

To serve those hoping to score the last remaining dollars, the agency on Sunday reopened its Recovery Loan Queue, the same tool it used in November to handle loans in limbo. The online site allows potential borrowers and lenders to check the progress of their loan request as the SBA allocates its remaining funding. On Monday, the SBA had 15 loans requests pending, for a total of $8.4 million.

Loan applications surged last week as the deadline neared for the Recovery Act incentives. The SBA says the sweeteners have significantly boosted small business lending from its pre-stimulus nadir at the end of 2008. The Small Business Administration's flagship lending program backed 37% more loans in its latest quarter than it did in the same quarter a year earlier, at the height of the credit freeze.

More than 1,000 banks had not made an SBA loan since 2007 have done so since the Recovery Act took effect a year ago, according to the SBA.

If the cash runs out, the SBA will continue backing small business loans, but borrowers and banks will have to resume paying fees for the guarantees the agency offers. Lenders will also need to put more of their own capital at risk: The stimulus funding enabled the SBA to temporarily lift the percentage of each loan it guarantees against default to 90%, up from a usual max of 85% on small loans and no more than 75% on larger loans.

The SBA would like to see Congress cough up the cash to extend the guarantees a little longer. Several proposed Congressional bills have included provisions to do that, including the jobs bill the House of Representatives passed in December, but none have yet made it through both chambers.

"We know there is still more work to be done," SBA chief Karen Mills said in a prepared statement. "As the president has requested, we will continue to work with Congress to extend these programs through September 2010."

The increased loan guarantee and fee waivers helped get SBA lending back on track, but the agency's loan programs still make up a small percentage of the overall small business credit landscape. The nation's biggest banks continue to shy away from making loans to small businesses: 11 major banks shaved $2.3 billion off their collective small business loan balance in December, according to a Treasury report released last week. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

|

Bankrupt toy retailer tells bankruptcy court it is looking at possibly reviving the Toys 'R' Us and Babies 'R' Us brands. More |

Land O'Lakes CEO Beth Ford charts her career path, from her first job to becoming the first openly gay CEO at a Fortune 500 company in an interview with CNN's Boss Files. More |

Honda and General Motors are creating a new generation of fully autonomous vehicles. More |

In 1998, Ntsiki Biyela won a scholarship to study wine making. Now she's about to launch her own brand. More |

Whether you hedge inflation or look for a return that outpaces inflation, here's how to prepare. More |