NEW YORK (CNNMoney) -- Google is teaming with MasterCard, Citigroup and Sprint to launch a new phone-based mobile payment system.

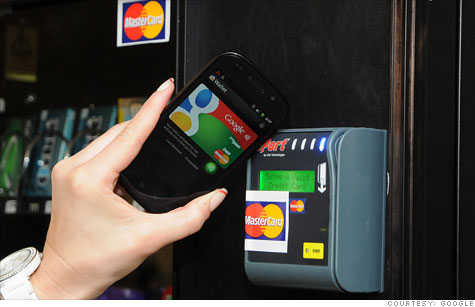

The project, called Google Wallet, will enable special chips embedded in many future Android devices to be used for payments. Instead of swiping a credit card, customers will be able to wave their Android phone in front of a reader to make a payment.

"We're about to embark on a new era of commerce where we bring online and offline together," Stephanie Tilenius, Google's vice president of commerce, said Thursday at a press event in New York unveiling the project. "We believe the shopping experience has not yet been transformed by technology or by magical experiences. Now, your phone can be your wallet -- you just tap, pay, and save."

For now, only Citibank (C, Fortune 500) customers will be able to use their phones as digital wallets, linking their phones to credit or debit cards, but Google developed an open platform that can be used on any device or card. The company hopes more partners will soon come on board. Android users will be able to manage their transactions via an application on their smartphones.

The system is only available on Sprint's (S, Fortune 500) Nexus S phone for now, but Google is requiring that near-field communications (NFC) chips be embedded on Android devices that launch with the latest version of the operating system. That means that most new Android phones going on sale later this year will be able to use Google's new payments system.

Google Wallet will launch in San Francisco and New York this summer, and will go national "in the coming months."

Google (GOOG, Fortune 500) said it won't be taking a cut of the transactions, like MasterCard (MA, Fortune 500) does. Instead, the search giant will help companies target advertising to customers based on their purchase history. Google will provide information to retailers that will allow them to direct offers and discounts to specific people.

That separate program, called Google Offers, will in many ways work like Groupon -- a company Google unsuccessfully targeted for a buyout earlier this year. Google Offers will send users a daily deal, and it will also give users check-in deals, targeted ads and local deals via Google Places.

The technology that enables mobile phones to become credit cards has been around for a while. The same NFC chips embedded in new Android devices exist in some credit cards and payment wands associated with customers' accounts. MasterCard, for instance, already has an NFC system called PayPass in place.

Google is far from the only company to delve into NFC. Verizon (VZ, Fortune 500), AT&T (T, Fortune 500) and T-Mobile last year said they would create a venture with Discover (DFS, Fortune 500) to allow users to pay with their cell phones.

But NFC payments have yet to take off in a big way. Just 150,000 contactless readers have been installed by U.S. retailers, according to the Federal Reserve. Google said Wallet will work at 120,000 retailers in the United States and 300,000 globally.

It's also unclear if NFC will be the technology that ultimately powers mobile payments. Twitter co-founder Jack Dorsey's startup Square, for instance, announced an iPad app that replaces cash registers at stores and lets customers pay for products with their Android or iOS devices or start tabs just by using their names. No hardware or NFC is involved.

Square this week announced that 500,000 Square card readers have been shipped, and said the company is processing $3 million in mobile payments a day.

Yet Google believes NFC is the best way forward, and it hopes its new technology will change the way people think about payments. NFC on a mobile device sends an encrypted signal to the reader, which is more difficult to steal and duplicate than the magnetic strip technology currently used by most credit cards. Users will need to enter a PIN to make the payment system work, reducing the threat of financial loss if their phones are stolen.

Also, Google demonstrated how users could add multiple cards, including rewards cards and coupons into their phones. Those rewards cards and coupons will automatically be applied when a user taps their phone to complete a purchase.

Users could click on online ads and save offers to their phones, or they could tap posters with NFC capabilities to get deals sent to their devices. Eventually, Google said users will literally be able to put everything that's in their wallet into their phones, including their drivers' licences.

The company has long envisioned a day when mobile phones become the central payment system for people around the world

In February, then-CEO Eric Schmidt envisioned a scenario where you would enter the task "buy pants" into your smartphone. Based on your shopping history, Google knows you like deals. It also knows where you are, since your smartphone has GPS. Your phone instructs you to go to a store near you that happens to have a great deal on pants, and Google tells the store to hold the pants at the counter for you.

When you arrive at the store, you just tap your smartphone onto a reader at the store to pay. ![]()