NEW YORK (CNNMoney) -- Just two weeks and a couple days.

That's how long Congress has to raise the debt ceiling, or risk economic catastrophe.

The deadline has been a long time coming. Treasury started sending letters to lawmakers in January urging them to raise the $14.3 trillion debt ceiling -- which is the U.S. legal borrowing limit.

More than six months have passed.

And still, there is a wide gulf between the positions staked out by Republican and Democrats. This in spite of calls for civility and bipartisanship from every corner, and a week of negotiations at the White House.

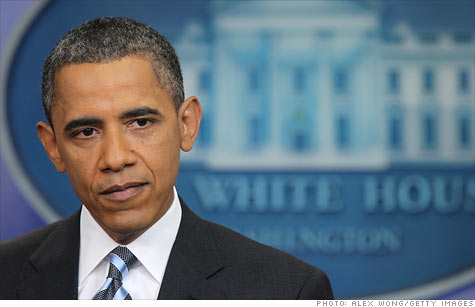

President Obama took to the bully pulpit on Friday, yet again making his case that politicians should pass a mix of spending cuts and revenue increases that add up to $4 billion or so.

But lawmakers still have no clear path forward. Talks have broken down. It's possible that negotiators could be called back to the White House this weekend, but nothing official has been announced.

The plans: The president has his $4 trillion plan. House Republicans have two or three smaller proposals of their own, and Sen. Mitch McConnell has crafted an emergency measure in case negotiations fail.

McConnell's plan sets up a mechanism only Congress would dream up. It would allow for three short-term increases in the debt ceiling while at the same time letting lawmakers register their disapproval.

Lawmakers have yet to coalesce around any one idea.

A main stumbling block is the issue of taxes. Obama and Democrats want to close loopholes that would lead to wealthy Americans and some corporations paying higher taxes.

Republicans oppose any tax hikes, a position they have held since day one.

Seven weeks' worth of talks between the parties led by Vice President Joe Biden broke down in June after House Majority Leader Eric Cantor left the negotiations over the issue of taxes.

But Obama continued the drumbeat Friday, citing polls that show most Americans want a package that contains a mixture of spending cuts and tax hikes.

"At what point do the folks over there start listening to the people who put them in office?" Obama said during a press conference. "Now is a good time."

The fallout: So far, investors have remained relatively calm. But as Aug. 2 approaches, fears will escalate. The quicker a deal gets done, the better it will be for capital markets and the country's credit rating.

But it's very possible -- despite all the sound and fury -- that lawmakers will wait until the last second to pass something.

"We are far from the time for a last ditch effort," House Speaker John Boehner said Friday, dismissing the need for Sen. McConnell's stopgap bill.

The lack of progress has clearly caught the attention of the ratings agencies.

Standard & Poors warned Thursday that it could soon downgrade the U.S. credit rating.

"[O]wing to the dynamics of the political debate on the debt ceiling, there is at least a one-in-two likelihood that we could lower the long-term rating on the U.S. within the next 90 days," the agency said in a statement.

The two other major rating agencies, Moody's Investors Services and Fitch Ratings, have also put the U.S. on notice.

A downgrade would mean that interest rates on U.S. bonds would go up. And it could have ramifications across global markets because U.S. bonds are considered the world's safe haven investment.

Some analysts have warned that a default on the country's debt would plunge the world economy into yet another recession. Federal Reserve Chairman Ben Bernanke said the fallout would be "catastrophic," "self defeating" and "dire."

Not everyone believes Bernanke.

A not insignificant number of House Republicans -- like Rep. Mo Brooks -- believe the United States could continue to pay interest on the debt to avoid default.

"There should be no default on August 2," Brooks told the Washington Post. "In fact, our credit rating should be improved by not raising the debt ceiling." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |