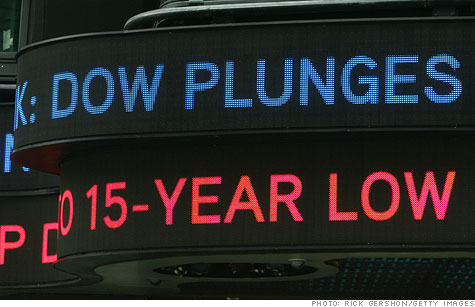

The stock plunge on Sept. 29, 2008, when the first bank bailout bill was voted down, is a reminder of a risk lawmakers take if they push debt ceiling vote to the last minute.

NEW YORK (CNNMoney) -- The debt ceiling talks, for weeks now, have been going on behind closed doors. The negotiations have been conducted by a tiny group of legislative leaders and President Obama's top aides.

All the while, the countdown to Aug. 2, when the government will no longer be able to pay all its bills, has marched closer.

Any proposal will still have to be put into legislative language, scored by the Congressional Budget Office and vetted by rank-and-file lawmakers whose votes will decide its fate.

Even after the principal negotiators announce a deal, the rest of Congress will have to be convinced to go along. The closer to D-Day Washington gets, the messier it will be.

Witness what happened on Sept. 29, 2008, when the House at first rejected the $700 billion bank bailout bill.

Weeks earlier, Fannie Mae and Freddie Mac had been placed into conservatorship by the Treasury Department. Lehman Brothers had filed for bankruptcy. AIG Corp, the world's biggest insurer, had been bailed out by the Federal Reserve.

After all that, the Senate passed the bill. And then, as markets watched, the measure was voted down in the House -- a defeat that shocked investors and congressional leaders on both sides of the aisle.

Following the vote, the Dow slumped 778 points, in the biggest single-day point loss ever.

A few days later, the House reversed course and passed a modified version of the bill. Some 58 members switched their votes.

Why was the process so hard? A principal reason is that it was rushed.

Lawmakers who voted against the bill warned that "being stampeded" into a decision would be a serious mistake.

"Wall Street is so hungry for the $700 billion they can taste it. To get it they need to ... create panic, block alternatives and herd the cattle. We ask Congress not to rush," California Democrat Rep. Brad Sherman said before the vote.

That sentiment stretched across party lines.

"I am voting against this today because it's not the best bill. It's the quickest bill," Rep. Marilyn Musgrave, Republican of Colorado, told the New York Times. "Taxpayers for generations will pay for our haste and there is no guarantee that they will ever see the benefits."

Norman Ornstein, a resident scholar at the American Enterprise Institute, said lawmakers now face a similar situation, but this time around, "It's worse."

Lawmakers aren't going to have a lot of time to consider their options. And all the negotiations are happening behind closed doors, limiting the involvement of rank-and-file members.

"With TARP, it wasn't clear that another day or two wouldn't make a big difference," Ornstein said. "If you take two to three days messing around with this, you end up with what could be a profound and very long lasting impact."

The White House has already warned that time is running short, saying that a deal needs to be completed in the next couple days in order to give Congress time to pass a bill.

Alabama Republican Sen. Jeff Sessions has voiced concern about the timeline, saying there is a "very real risk that no text will be available until the last minute" and that a bare minimum of seven days is needed to review legislation.

"The real endgame here is not August 2," Ornstein said. "It takes time to put any agreement into legislative language and get it scored. It sure as hell doesn't look to me like we are urgently moving to make sure that happens."

And like 2008, not everyone is dealing with the same set of facts. At that time, every high-ranking government official from then-President Bush on down was warning of dire consequences if TARP faltered in the House.

That moved a few members into the "yes" column, but not all.

"We're on the cusp of a complete catastrophic credit meltdown. There is no liquidity in the market," Rep. Sue Myrick, a North Carolina Republican, said in a statement before the vote. "We are out of time. Either you believe that fact, or you don't. I do."

Right now, despite warnings from Treasury Secretary Tim Geithner, President Obama, Federal Reserve Chairman Ben Bernanke and even House Speaker John Boehner, a number of Republicans remain so-called debt ceiling deniers.

"You've got enough people out there, way too many people, who aren't going to be convinced until Armageddon actually happens," Ornstein said. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |