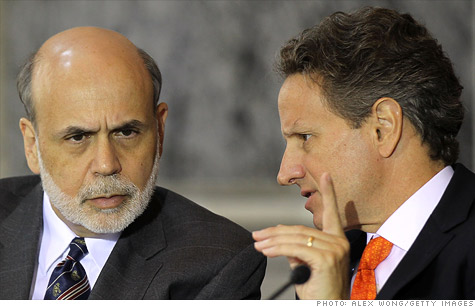

It could be 2008 all over again for Ben Bernanke and Tim Geithner.

NEW YORK (CNNMoney) -- Could a failure to raise the debt ceiling spark the same kind of credit crisis that plunged the global economy into a recession in 2008?

Short answer: Yes. That's exactly the situation some experts are warning the United States will find itself in if the Treasury Department were to miss interest payments.

The government's debt -- in the form of Treasuries -- is the lifeblood of the credit system and provides the grease for the short-term lending banks rely on.

The doomsday scenario goes like this: Worried short-term lenders start demanding more collateral, while the value of Treasuries becomes muddled. Alternatively, a default results in a downgrade of U.S. debt, spurring some investors to sell Treasuries.

Either way, the impact ripples out into the economy. Banks are unable to borrow, and credit markets freeze.

It's the kind of crisis that quickly transfers from Wall Street to Main Street.

"It could produce a downward spiral," said Viral Acharya, a professor of finance at NYU Stern.

Standard & Poor's rating agency warned this week that a "selective default," even if temporary, could be disastrous.

"[W]e could envisage a systemic and global macroeconomic disruption ... a lack of liquidity would become a critical issue," the agency said. "This could look similar to the fall of 2008, when a complete loss of investor confidence and a massive flight to quality brought the global funding markets to a temporary stand-still."

That's the kind of outcome that has policymakers on edge.

Treasury Secretary Tim Geithner met Friday with Federal Reserve Chairman Ben Bernanke and New York Federal Reserve Bank President William Dudley in Washington. In a joint statement, they said they discussed "the implications for the U.S. economy if Congress fails to act."

While it won't reveal its plans, the Fed is clearly considering its options. With the Aug. 2 deadline to raise the debt ceiling only a week and a half away, among the questions is whether the Fed will continue to accept Treasury debt as collateral for loans.

"Do we treat them as if they didn't default, in which case we would be saying we are pretending it never happened? Or do we treat them as if they defaulted and don't lend against them? Those are more policy questions," Philadelphia Fed President Charles Plosser told Reuters this week.

Money market funds provide one example of how things could quickly spiral out of control. One of the safest places to stash cash, they have long provided stability for investors.

But they hold a ton of Treasuries, and are used by investors who need quick access to cash.

S&P warns of a scenario in which a large money market fund "breaks the buck," or values its shares at less than $1 for every dollar invested.

That's exactly what happened to the Reserve Primary Fund in September 2008, an event that resulted in what amounted to a multi-billion dollar run on money market funds. In the end, the federal government stepped in to offer a temporary guarantee for the $3.6 trillion in money fund assets.

S&P is worried that history might repeat itself in the wake of a default as Treasury and other government securities lose value.

The worst part? Should the U.S. default, Acharya says it could hurt the dollar's status as the world's reserve currency and undermine the faith other nations have in the United States.

"Missing an interest payment is an un-required disaster," Acharya said. "And it could kickstart a diversification into other assets." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |