Search News

FORTUNE -- Investment experts always counsel against putting money into mutual funds on a run of smoking-hot performance. A long-term record is the real test. But what to make of enduring stars whose results have fallen to earth? Is it a sign they've lost their golden touch -- or just a lull before another blistering streak?

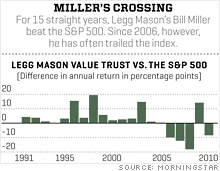

A number of revered managers have experienced setbacks in recent years. The prime example is Bill Miller, the Legg Mason Value Trust (LMVTX) manager who famously beat the market 15 years running before trailing it three years in a row. Miller's reversal included a spectacular flameout in 2008 when a giant bet on financial stocks caused his fund to lose 55%, or 18 percentage points worse than the S&P 500 (SPX). Ken Heebner's story is a close rival: After his CGM Focus Fund (CGMFX) racked up astounding average annual returns of 32% from 2000 through 2007 -- this magazine hailed him as "America's hottest investor" -- the fund landed in the bottom 4% of domestic stock funds in 2008, 2009, and again so far this ear.

Other slumping long-term stars include Bill Nygren of the Oakmark Fund (OAKMX), Ron Muhlenkamp of the fund that bears his name (MUHLX), and Chris Davis of Davis Advisors (NYVTX). Most recently Fairholme's (FAIRX) Bruce Berkowitz, named Morningstar's "manager of the decade" just last year, trailed 99% of his peers in 2010.

Few can evade the law of gravity. One study calculated the odds of Miller's streak at one in 2.3 million, and in 2005, Miller himself warned shareholders that "if your expectation is that we will outperform the market every year, you can expect to be disappointed." It's not just a question of reverting to the mean. Markets favor certain kinds of investors in cyclical patterns. A value-oriented manager who thrived when the average price/equity ratio of large-cap stocks was rising effectively has the odds stacked against him as he seeks new investments.

Then there are the twin problems of investor expectations and behavior. "As a fund gets hotter, new investors get more and more unrealistic," says Russel Kinnel, Morningstar's director of fund research. "They buy into these funds expecting the outperformance to continue forever. Then, after a quarter or two of losses, they think the 'genius' has somehow lost his touch, somehow become a total idiot, so the money flies out the door. They forget that everyone, even Warren Buffett, has off years."

It's the investors themselves who suffer most. They miss out on the fund's best performance and bear the worst. And it forces managers to sell stocks just when they see bargains emerging -- and buy when prices are high.

It would be too simplistic to invest blindly in fallen stars on the assumption that they'll bounce back. After all, some deserve to be down. But we examined portfolios, canvassed fund experts, spoke with the managers themselves, and found three that seem primed to bounce back -- all of them arguing, to one degree or another, that mega-cap stocks are now relatively undervalued.

Legg Mason Value Trust rebounded in 2009 but has again fallen into the bottom 10% of large-cap funds. Manager Miller notes that U.S. large-caps, which he favors, are trading at 25-year lows compared with midcaps. "Large-cap equities are now back to a level where there's a great margin of error built into them," he says. His top areas are the cheapest: technology and financials. Of the latter, he says, "The big banks are collectively trading below book value at a time when they are profitable, which has never happened before." Meanwhile the fund's embedded tax loss, equal to 60% of the fund's net asset value, acts like a built-in tax shelter for investors.

Oakmark's Nygren also likes financials and tech. Banks like J.P. Morgan Chase (JPM, Fortune 500), Wells Fargo (WFC, Fortune 500), and Bank of America (BAC, Fortune 500) are cheap and won't always face such strong populist and political animus: "They're an easy scapegoat," he says, adding that the sloppy loans they made during the boom are starting to roll off and are being replaced by higher-quality ones. Nygren also owns tech stocks such as Google (GOOG, Fortune 500), Apple (AAPL, Fortune 500), and Microsoft (MSFT, Fortune 500), all trading at a discount to the S&P 500 when you factor their large cash hoards into the equation. "We love growth companies," he says, "but we usually don't get an opportunity to own them."

Berkowitz of Fairholme has a history of buying beaten-down stocks frighteningly early -- and making a killing when, eventually, they turn around. Lately he's been so early on financials that he admitted he was wrong to invest so heavily in AIG (AIG, Fortune 500) when he did. Other big holdings in the sector include Bank of America, Morgan Stanley (MS, Fortune 500), Goldman Sachs (GS, Fortune 500), and Citigroup (C, Fortune 500). True to form, he's sticking with the group. "Historically, we run away from the popular and buy the hated," he says. "Financials are priced like they'll be unable to recover. But the numbers show they're already recovering." As for AIG in particular, he notes that it's trading far below book value even though it still runs world-class insurance businesses. "The price has been paid," he says of its implosion. New investors can take heart that the most devastating recent AIG news, that the federal government started selling its stake well below the price Berkowitz had expected, is already reflected in the fund's net asset value.

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: