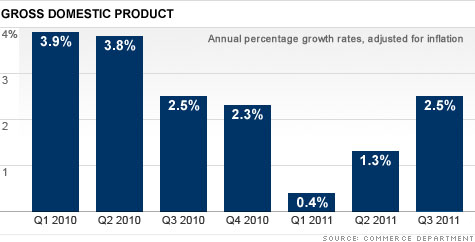

NEW YORK (CNNMoney) -- The nation's economy regained some much-needed strength in the third quarter, as the pace of growth nearly doubled compared to the previous three months.

Gross domestic product, the broadest measure of U.S. economic health, grew at a 2.5% annual rate in the quarter after adjusting for inflation. That's up from the disappointing 1.3% growth in the second quarter and the anemic 0.4% pace in the first three months of the year.

The reading matched the forecast of economists surveyed by CNNMoney.

"The economy has shed fears of a double-dip recession," said Sung Won Sohn, economics professor at Cal State University-Channel Islands, who said growth is no longer "stuck in neutral going nowhere fast.

"However, it is too early to celebrate a return to a robust economic recovery," he added.

Stronger consumer spending was a key driver in the improved reading, as personal consumption jumped to a 2.4% growth rate from only 0.7% gain in the second quarter.

Businesses also spent more, as investment in equipment and software, a good barometer of that reading, spiked to a 17.4% growth rate.

That spending helped to make up for the cutback in government spending, which was constrained by both the debt ceiling debate in Washington, and budget cuts at the start of new fiscal years for state and local governments.

Nondefense federal spending fell at a 3.7% rate, while state and local government spending declined at a 1.3% rate.

"Historically, this sector has added 0.25 percentage points to economic growth. This year, it will subtract from growth by that much," said Sohn.

The 2.5% growth rate is still considered a bit below average during an economic recovery, and mostly looks good in comparison to the weak first half of this year. Economists say it typically takes growth of 3% or better to prompt businesses to start hiring again to meet stronger demand for their products.

And economists surveyed by CNNMoney ahead of the report forecast that growth will slow down again in the fourth quarter and throughout 2012, as they expect a 2.2% annual growth rate in the fourth quarter, and 2.3% growth from that quarter through the end of 2012.

"The better-than-expected performance this summer doesn't look sustainable," said Kathy Bostjancic, director for macroeconomic analysis for The Conference Board. "Weak consumer sentiment could limit the rise in consumption through the holiday season and right into winter. Cuts in spending by state and local municipalities weigh on the economy."

Paul Ashworth, chief U.S. economist at Capital Economics, said the increased consumer spending came from cuts in the savings rate rather than from gains in income. He's also concerned that exports, an area of strength in recent quarters, are likely to decline in coming quarters due to slowdowns around the world. And he's looking for further cutbacks in government spending.

"The upshot is that a lot of the strength in the third quarter was due to temporary factors that will fade next year," he said.

Many economists are still worried about the economy falling into a new recession, especially if there is a shock to the financial markets from the sovereign debt crisis in Europe. Those surveyed by CNNMoney put the chance of new recession at about one in three.

But some economists said they were encouraged by the details in the report.

Joseph LaVorgna, chief U.S. economist for Deutsche Bank, raised his forecast for fourth quarter growth to 3% from 2.2% after reading the report. He was encouraged by the fact that the third-quarter reading was driven by better-than-expected spending rather than just businesses building up inventories.

"We believe that, based on the surge in order backlogs last quarter, production is poised to grow faster in the current quarter," he said.

The report shows that during the quarter the economy finally crawled out of the hole it fell into during the Great Recession, when overall economic activity declined by 5.1%. This was the first quarter when the inflation adjusted value of all economic activity topped the level that existed in the fourth quarter of 2007, when the downturn began. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |