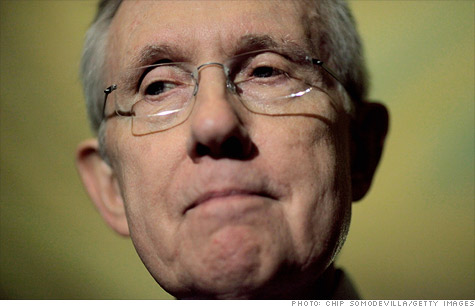

Senate Democrats, led by Harry Reid, are expected to drop their push for the tax.

NEW YORK (CNNMoney) -- It looks like the millionaire surtax is going down again.

Democrats have pushed for weeks to impose a millionaire surtax to help pay for the cost of extending the payroll tax cut. Republicans have said it would be a job-killer.

On Wednesday night, with time running out before Congress adjourns for the year, it appeared that Democrats were ready to give up in the name of getting a deal done. A source told CNN that Senate Democrats would propose a new plan that did not include the tax. (Read: The latest on negotiations)

The demise of this version of the millionaire tax would not be a surprise. Lawmakers have already voted down a surtax of 5.6%, then 3.25% and most recently 1.9%.

But the idea of taxing the rich will come up again and again next year, since themes of income inequality and tax fairness will be sounded repeatedly on the campaign trail.

Urban Institute resident fellow Howard Gleckman points out that an extra tax on millionaires may make for great politics but it would make for awful policy, although not for the reasons that many in the GOP suggest.

Republicans still cleave to the notion that to ever ask millionaires to pay more in taxes will bring the economy to a screeching halt because it would hurt small business job creation.

But there are problems with that reasoning:

--A very small percentage of tax filers with business income make more than $1 million.

--There is no way to tell how many new jobs those millionaires create.

--And business income can come from activities that don't result in a lot of hiring, such as owning rental property or investing in a partnership.

For Gleckman, a big problem with the millionaire surtax is that it feeds the myth that the super rich can pay for everything. They can't. There are not enough of them.

And by applying a surtax here and a surtax there, soon you're talking serious rate creep -- to levels that could be counterproductive. The higher rates become the more likely it is that the rich will look for ways to avoid paying them.

If the Bush tax cuts expire, the top rate goes to 39.6% and the value of certain deductions goes down. Add in a new Medicare tax for high-income households starting in 2013, and the top rate could approach 50% if Congress passed a 5.6% surtax, Gleckman noted.

Despite the flaws in the parties' strategies -- Democrats always reach first to tax the rich and Republicans always rush to protect them even at the expense of everyone else -- each contains a bit of truth the other side will have to accept sooner or later.

Both the rich and the middle class eventually will have to contribute to efforts to spur the economy and stabilize the federal budget.

"Democrats today can't solve our nation's many budgetary woes primarily by taxing the rich, and Republicans risk alienating the middle class when they try to spare the rich from sharing the additional burdens most Americans soon must bear," former Treasury official Eugene Steuerle wrote in his public policy column "The Government We Deserve."

The rich will have to pay more in taxes, he notes, because even if spending is cut across the board, they won't feel the pinch since they don't rely on government spending to get by.

And the middle class will eventually need to accept some spending cuts and tax increases, Steuerle said, "not because the rich can't pay more, but because most income in the economy resides with that 80 percent of the population that is neither poor nor rich." ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |