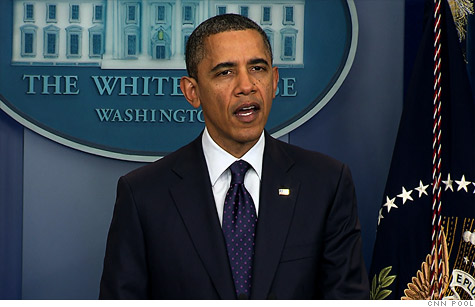

President Obama Friday signed into law a two-month extension of the payroll tax cut and jobless benefits.

NEW YORK (CNNMoney) -- Well, that was painful.

The House and Senate on Friday finally approved and President Obama signed into law a short-term extension of the payroll tax cut and federal unemployment benefits, and staved off a steep cut in pay to Medicare doctors.

But, once again, Congress took a tortured path. And on legislation that, in the scheme of things, was a modest stopgap measure whose main provisions enjoyed bipartisan support.

After nearly a week of adamant House Republican opposition, Speaker John Boehner relented Thursday night, announcing that he and Senate Majority Leader Harry Reid had struck a deal on a bill that the Senate passed on Dec. 17.

The new law ensures that in January 160 million American workers do not see a reduction in their paychecks, the long-term jobless don't see an interruption in their unemployment checks and Medicare doctors don't suffer a drastic cut in their pay.

Many politicians and economists had pushed to keep the tax cut and unemployment benefits in place for fear of dragging down an already slow economic recovery.

The debate over the extensions aren't over. Lawmakers will return in January to negotiate a full-year extension. There's little reason to believe the negotiations will be any easier than they were in recent weeks, when the parties could not agree on how to pay for the longer-term extension.

Payroll tax cut extended: The law extends the payroll tax cut, set to expire on Dec. 31, through Feb. 29.

That means workers will only pay 4.2% on the first $110,100 of their wages into Social Security. That is 2 percentage points below the normal 6.2% rate.

If the payroll tax cut is extended for all of 2012 -- which both parties say they want and will work to do when they return from their Christmas recess -- workers would save anywhere from several hundred dollars if they're low-income to more than $2,000 if they earn six figures.

Estimated cost of a two-month extension: $21 billion.

Jobless benefits extended: Emergency federal unemployment benefits, also scheduled to expire on Dec. 31, will be extended through February. Without that extension, an estimated 1.8 million jobless workers in January would have run out of benefits, which average $296 a week.

Those emergency benefits make it possible for the unemployed to get unemployment checks for up to 99 weeks of benefits in total. Whether they can collect that maximum depends on their state's unemployment rate and their work history.

Congress has extended the long-term emergency benefits several times since 2008.

Estimated cost: $8.4 billion.

"Doc fix" extended: The new law prevents a scheduled 27% cut in payments to Medicare physicians for the first two months of next year.

Under the law, Medicare reimbursements to doctors must be reduced whenever those payments exceed a certain target. Since 2003, that target has been exceeded, but Congress has routinely prevented those pay cuts.

The American Medical Association has noted that even with the regular intervention by Congress, Medicare payments lag 20% behind the cost of caring for seniors.

Many in Congress would like to pass a permanent doc fix, but the biggest stumbling block to doing so is figuring how to pay for the estimated $300 billion cost over the first decade.

Estimated cost: $3.6 billion.

Faster push for pipeline: In a nod to Republican wishes, the law requires President Obama to expedite his decision on whether to allow construction of the 1,700-mile Keystone oil pipeline.

Paying for the extensions: The law calls on mortgage financing giants Fannie Mae (FNMA, Fortune 500) and Freddie Mac (FMCC, Fortune 500) to charge lenders more to guarantee repayment of new loans. Fannie and Freddie play a central role in the housing market by purchasing mortgages from banks and bundling them into mortgage-backed securities.

Estimated to raise: $36 billion.

What didn't make the cut: Not every expiring tax provision is accounted for in the new law. Left out was any action on a host of other "temporary" tax breaks that expire this year. These include the research and development credit for businesses and a state and local sales tax deduction for individuals.

Also left out was the usual fix to protect the middle class from getting hit by the Alternative Minimum Tax when they file their taxes for 2012.

Congress could extend the breaks next year and make them retroactive to Jan. 1. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |