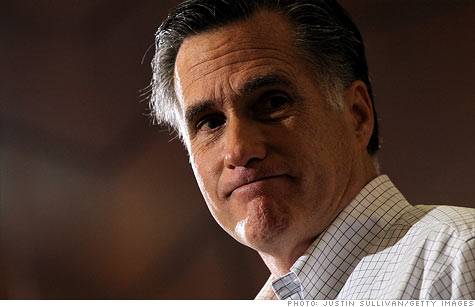

Mitt Romney made a lot of money managing private equity. How his and other private equity managers' paydays are taxed has been a bone of contention in Congress for several years.

NEW YORK (CNNMoney) -- Should Republican presidential candidate Mitt Romney choose to release his tax returns, it likely will spur yet more debate about how much the rich should pay in taxes.

In particular, a lot of scrutiny may be given to how much tax Romney paid on the money he has made from Bain Capital, an investment firm he founded in 1984 and left in 1999.

That's because the U.S. tax code lets fund managers of some investment firms pay a far lower tax rate on much of their compensation than they would if that money were treated as a salary or bonus.

The rule applies to managers of venture capital funds and private equity funds, both of which Bain runs.

The firm, which is a privately held investment partnership, uses money from outside investors to either invest in start-ups, buy out public companies, or invest capital in private ones, all in an attempt to boost their value and sell them at a profit.

Compensation for general partners -- as Romney was at Bain -- is typically based in part on the profits made on winning investments.

The partnership will set a minimum rate of return that the fund must achieve when it sells an asset, say 8%. And the general partners then get 20% of any profits above that. That compensation is called "carried interest."

But rather than being taxed as regular income -- rates on which go as high as 35% - carried interest is taxed at the much lower capital gains rate of 15%.

The case made for applying the capital gains rate is to encourage investment. But general partners are entitled to carried interest even if they have not invested their own money in the fund (although most do invest some).

That's why many -- including President Obama -- have called for carried interest to be taxed as regular income that is paid in exchange for investment services.

General partners are also paid a fixed management fee, which is taxed as ordinary income. Typically that fee is worth about 2% of the fund's assets.

Since 1999, Romney - whose personal fortune is estimated to be as high as $264 million -- has continued to profit from Bain's work thanks to the terms of his retirement package.

And on Tuesday, in response to a question in South Carolina, Romney said he pays an effective federal tax rate of about 15% because most of his income comes from investments.

Those who support taxing carried interest as a capital gain make a few arguments.

First, they say, the "sweat equity" of the general partner is as valuable as the financial equity of fund investors.

Second, the partner gets paid carried interest only if the fund does well. And it's potentially subject to a clawback if other asset sales don't meet their minimum "hurdle" rates.

Last, they contend, if rates did go up, it would discourage investment and risk-taking.

"Carried interest is an important aspect of the capital gains tax system that is based on the uniquely American principle that we reward those who take entrepreneurial risk, whether that risk involves investing capital or other aspects of ownership that require years of time, effort, and vision," said Ken Spain, a spokesman for the Private Equity Growth Capital Council.

Others aren't convinced.

"It's not going to change how people do business," said Victor Fleischer, an associate professor of law specializing in venture capital and private equity taxation at the University of Colorado. That's because the tax increase would only affect general partners, not the people who invest the bulk of money in private equity funds, he said.

Moreover, just because carried interest is dependent on good performance and may be clawed back isn't reason to tax it more lightly than other income, Fleischer added.

"The fact that compensation is risky and not guaranteed doesn't justify treating it as a capital gain."

Since 2007, measures to tax carried interest as ordinary income have been included in various bills, often to help pay for the cost of other tax cuts or spending increases. Should the change ever pass, it's not expected to swell federal coffers, raising less than $20 billion over 10 years. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |