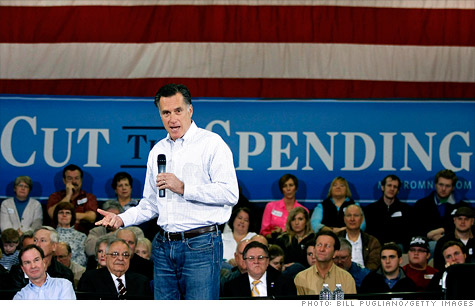

Mitt Romney has a new tax plan.

NEW YORK (CNNMoney) -- In a switch to a more aggressive tax plan, Mitt Romney said Wednesday that he now favors cutting marginal tax rates for individuals by 20%.

The candidate had previously said he would "maintain current tax rates on personal income" as president before moving to a "fairer, flatter, simpler tax structure" in the future.

Now Romney appears to be accelerating that timetable, announcing a move that would reduce the current top rate paid on income from 35% to 28%, with similar reductions across all tax brackets.

For example, Americans in the lowest bracket would pay 8% instead of 10%. Americans closer to the middle would pay 20% instead of 25%.

"Obviously this is a bigger step," said Roberton Williams, a Tax Policy Center scholar who has been analyzing the 2012 candidates' tax plans. "It's a substantial cut and quite the switch."

The tax cuts will be offset by limits placed on deductions, exemptions and credits currently available to top-level income earners.

"The right way forward is a flatter, fairer, simpler tax system that generates the revenue we need to fund a smaller government that is restrained to its historical size," Romney said in a statement.

In a conference call with reporters, Romney economic adviser Glenn Hubbard said that the tax plan, even with rate cuts for individuals, should be revenue neutral.

Hubbard also said Romney was willing to examine the tax treatment of carried interest, a provision that allows fund managers to pay the 15% capital gains rate on portions of their income.

Should he become president, Hubbard said Romney would instruct his Treasury secretary to study the issue to determine if a higher rate was appropriate.

The candidate is expected to reveal more details in a speech to the Detroit Economic Club on Friday.

The policy change comes as Rick Santorum, once considered a long shot, sits at the top of national polls and is neck-and-neck with Romney in the latest surveys in Arizona and Michigan -- which both hold primaries Tuesday.

The candidate's initial economic plan -- released in September -- was billed by the Romney campaign as "the most detailed plan for economic growth and job creation of any presidential candidate."

But it fell flat with some influential conservatives, including the Wall Street Journal editorial board, which labeled the proposals "surprisingly timid and tactical."

The Tax Foundation, a think tank that generally advocates for lower tax rates, said that Romney's initial plan for the individual code "really takes no step toward fundamental reform."

The updated plan, released by the campaign, reiterates other proposals that were first laid out in September, including provisions that would eliminate taxes on interest, dividends and capital gains for taxpayers who make less than $200,000.

It also calls for the elimination of the estate tax, and a reduction in the tax rate paid by corporations from 35% to 25%.

On corporate taxes, Romney still favors higher rates than his competitors.

Romney's 25% proposed rate carries a less aggressive reduction than that of Gingrich (12.5%), Rick Santorum (17.5%) or Ron Paul (15%).

Romney had previously hinted at changes in his tax plan that would include lower marginal tax rates on income.

During a debate in January, Romney suggested he would lower the top rate to 25% or even 20% when asked to identify the highest rate any American should pay.

"More than 25%, I think, is taking too much out of our pockets," Romney said. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates:

| Latest Report | Next Update |

|---|---|

| Home prices | Aug 28 |

| Consumer confidence | Aug 28 |

| GDP | Aug 29 |

| Manufacturing (ISM) | Sept 4 |

| Jobs | Sept 7 |

| Inflation (CPI) | Sept 14 |

| Retail sales | Sept 14 |