Search News

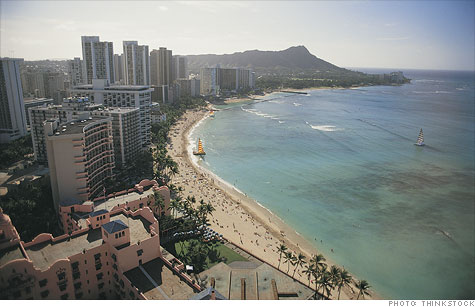

Honolulu is the nation's best market to be a renter rather than a buyer.

NEW YORK (CNNMoney) -- It's the eternal question in real estate: Should I buy or rent?

The answer has never been clearer: Buy.

In 98 of the top 100 housing markets, buying a home is more affordable than renting, according to the online real estate company Trulia. Only Honolulu and San Francisco buck the trend.

There are several reasons. Home prices are falling. Mortgage interest rates are at historically low levels. And rents are on the rise.

Of course, many renters are not in a position to buy. For one, it's hard to get a mortgage these days, despite low rates. And paying rent can push them further away from being able to afford to buy.

"Rising rents make it harder for people to save for a down payment, which is the biggest barrier to buying a home that aspiring homeowners face," Jed Kolko, Trulia's chief economist.

The nation's cheapest buyer's market is Detroit, where purchasing is only 3.7 times more expensive than renting.

Other top five metro areas where buying is much better than renting are Oklahoma City, Dayton, Ohio,Warren, Mich. and Toledo, Ohio.

Rankings like these, however, can obscure the factors that go into each decision.

Housing markets, even within a single metro area, typically have local submarkets. Take New York City, for example. Renting in Manhattan is more affordable than buying. But in suburban Westchester County just miles to the north, buying is the more affordable option.

The size of the home can also make a difference. In some markets, renting can be a better deal on larger homes, according to Trulia.

In San Francisco, for example, studio and one-bedroom apartments sell for 13.1 times rent, while three bedrooms or larger sell for more than 18 times rent.

The Trulia survey does not take into account home price trends, which are another factor for individuals choosing whether to buy or rent.

"People will pay more for a home if they expect prices to rise and give them a better return on their investment," said Kolko.

Those calculations are about to change, according to Ken H. Johnson, a professor of real estate at Florida International who has studied the buy-vs-rent question extensively. He believes home prices nationally have bottomed.

"The ship has turned," he said. "Markets should slowly start to recover. Housing will return to its traditional role of a safety investment."

If so, that adds an incentive to buy. And investing in many of the most expensive markets may be even safer.

Kolko pointed out that places like Honolulu, San Francisco and Boston have strong long-term growth prospects. They also have little physical space to grow, a factor that tends to keep prices strong.

On the other hand, old areas that aren't growing much -- while cheap -- may not return much in the long run.

"Buying is much cheaper than renting in slow-growing places with high vacancy rates and land to spare, like Detroit and Cleveland, where prices are unlikely to improve much in the future," he said. ![]()

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: