Search News

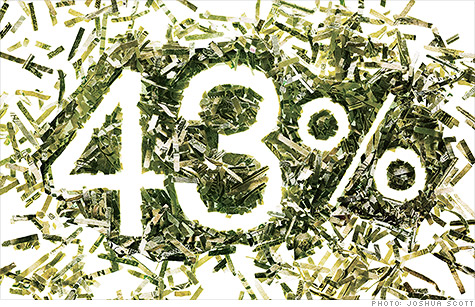

43% of Americans cut out cash for a week

(MONEY Magazine) -- Are cash payments becoming a thing of the past?

Money never goes out of style, but the paper version seems to have lost some appeal: Able to buy stuff with debit cards, credit cards, and even mobile phones, two in five adults have gone cashless for an entire week, according to a recent survey by Rasmussen Reports.

While plastic is convenient, it's also a threat to thrift: A 2011 study found that people paying with cash think more about a purchase's costs; those using credit dwell more on the benefits -- and are primed to pay more.

MAKE IT PAY

Using cash? Ask for a discount. Changes to Visa and MasterCard rules in 2010 permit merchants to cut prices for customers bearing legal tender.

Mom-and-pop shops might knock 2% to 3% off your bill, says SmartCredit.com CEO John Ulzheimer.

Using plastic? Put off buying unplanned purchases a few days, says Connecticut College psychology professor Stuart Vyse.

You'll duplicate the cash-economy delay of having to get money from the bank -- and give yourself time to reconsider what you really need to buy. ![]()

Carlos Rodriguez is trying to rid himself of $15,000 in credit card debt, while paying his mortgage and saving for his son's college education.

| Overnight Avg Rate | Latest | Change | Last Week |

|---|---|---|---|

| 30 yr fixed | 3.80% | 3.88% | |

| 15 yr fixed | 3.20% | 3.23% | |

| 5/1 ARM | 3.84% | 3.88% | |

| 30 yr refi | 3.82% | 3.93% | |

| 15 yr refi | 3.20% | 3.23% |

Today's featured rates: