There's no holding back the Santa Claus rally.

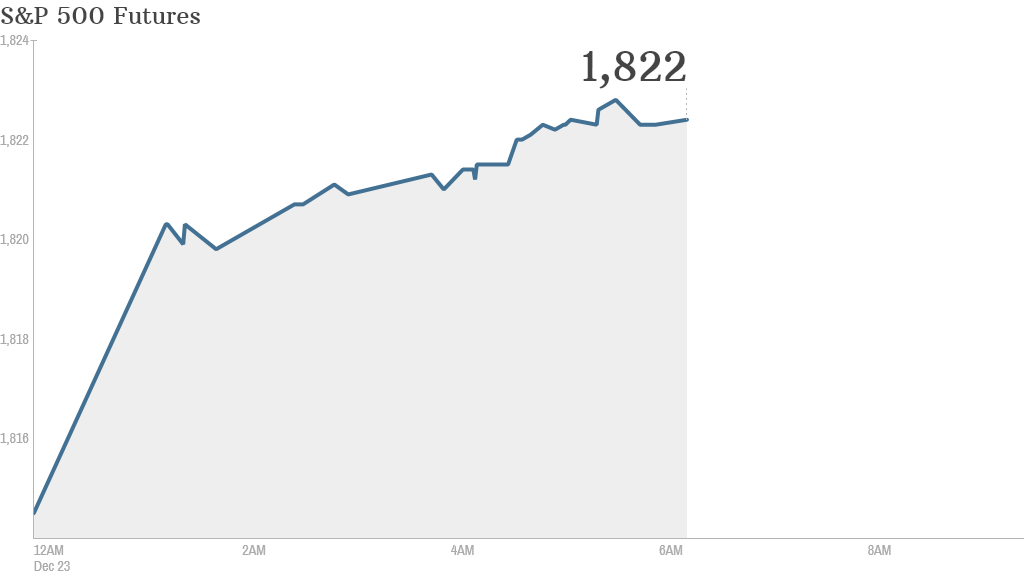

U.S. stock futures were looking buoyant ahead of Monday's opening bell, indicating markets could hit another record high before the holiday break.

The S&P 500, Dow Jones industrial average and Nasdaq were all moving higher, with the Nasdaq looking like it could pop up by nearly 1% when markets open.

The Nasdaq is getting a boost from Apple (AAPL), with shares in the iPhone maker surging by 3% in pre-market trading after the company announced Sunday it had inked an important sales deal in China.

Also, Facebook (FB) kicks off its first day of trading as part of the S&P 500, making it easier for investors to own shares.

Related: Apple inks China Mobile deal

Investors may also be feeling increasingly confident after the head of the International Monetary Fund, Christine Lagarde, said her organization was much more upbeat about the U.S. economic recovery.

"We see a lot more certainty for 2014," Lagarde said in an interview Sunday on NBC. She said the IMF would raise its forecast for the U.S. economy, in part because Congress had struck a deal on the budget and the Federal Reserve had managed its decision to begin reducing monetary stimulus effectively.

Related: Fear & Greed Index stuck in neutral

Further gains Monday would build upon a strong performance on Friday, when markets hit fresh record highs.

Looking to the day ahead, the U.S. Commerce Department will release its monthly reports on personal income and spending at 8:30 a.m. ET. At 9:55, the University of Michigan and Thomson Reuters will release data on U.S. consumer sentiment.

There are no big corporate earnings announcements expected Monday.

Related: Countdown to Obamacare deadlines

On international markets, China has been grabbing the headlines as investors continue to worry about a cash crunch. However, the Chinese central bank said it had pumped liquidity into the system, leading Asian stock markets to notch up modest gains Monday.

The main European markets were moving higher in morning trading.

The Tokyo Stock Exchange was closed for a holiday.