Fading concern about emerging markets and progress towards a debt ceiling deal in Washington could make for a fifth day of stock market gains Wednesday.

Surprisingly robust January trade data from China helped push Asian and European stocks higher, after U.S. markets posted strong gains Tuesday.

The Dow, S&P 500 and Nasdaq rallied after Fed chairwoman Janet Yellen stressed that monetary policy is unlikely to change much. It was the Dow's fourth consecutive gain and its largest one-day point and percentage gain since Dec. 18.

In testimony before the House, Yellen said the Fed will continue reducing its stimulus as the economy gradually improves, and said recent emerging market turmoil posed no real risk to the outlook.

"Janet Yellen managed both to make it clear that the Fed intends to stick to its current path of gradually slowing the pace of bond-buying, and to sound suitably dovish about the outlook for wages, inflation, and monetary policy overall," wrote Kit Juckes of Societe Generale, in a market report. "In the process, she propelled equity indices higher."

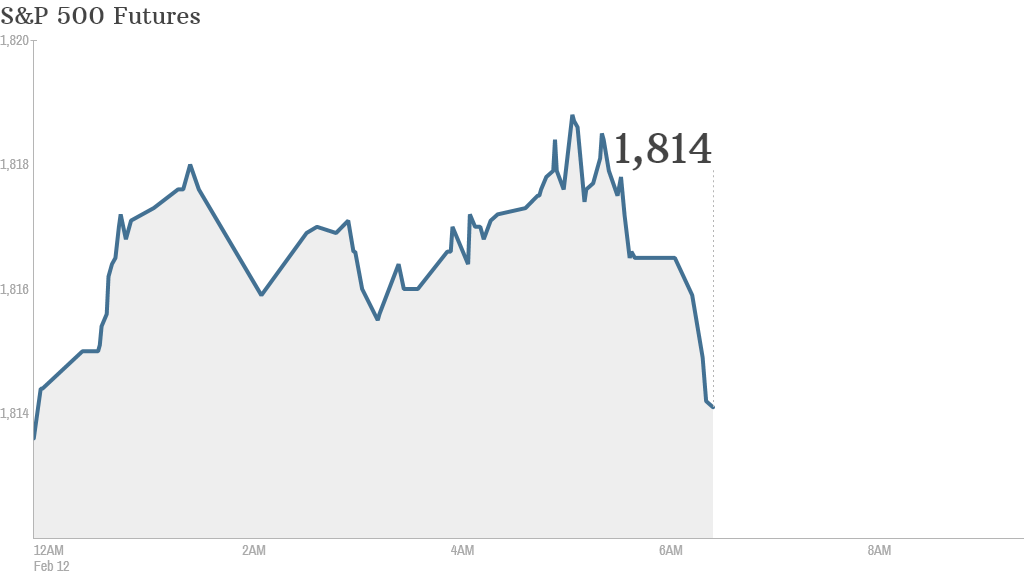

News that the House had voted to raise the limit on U.S. borrowing for a year could give markets another push. The Senate is expected to vote on the measure Wednesday. U.S. stock futures were ticking higher.

Related: Fear & Greed Index no longer feeling extreme fear

In other economic news, the U.S. Treasury will release its monthly budget statement Wednesday at 2 p.m. ET.

And on the corporate front, Cisco (CSCO) and Zillow (Z) will report quarterly earnings after the bell.

Shares for ING Groep (IDG) jumped in premarket trading after the Dutch bank reported significant quarterly increases in earnings year-to-year. French bank Societe Generale (SCGLF) also reported a quarterly jump in profit.

In after-hours trading, shares of DaVita HealthCare Partners (DVA) and retailer Fossil (FOSL) rose after reporting quarterly earnings that beat expectations.

Amazon (AMZN) shares dipped before the open after the online retailer announced that it would hire 2,500 full-time workers at its fulfillment centers, in addition to the 20,000 that it hired last year.

European markets were moving higher in morning trading, following gains on Asian markets.

The Shanghai Composite added 0.3%, while Hong Kong's Hang Seng advanced 1.5% and the Nikkei rose 0.6%.

China reported a 10% surge in exports for January, which provided a boost to markets despite warnings from economists that the data may have been distorted by over-invoicing and the Lunar New Year holiday.