With little U.S. economic or corporate news on the docket Monday, investors kept an eye on the rest of the world to get a sense of where the market is headed.

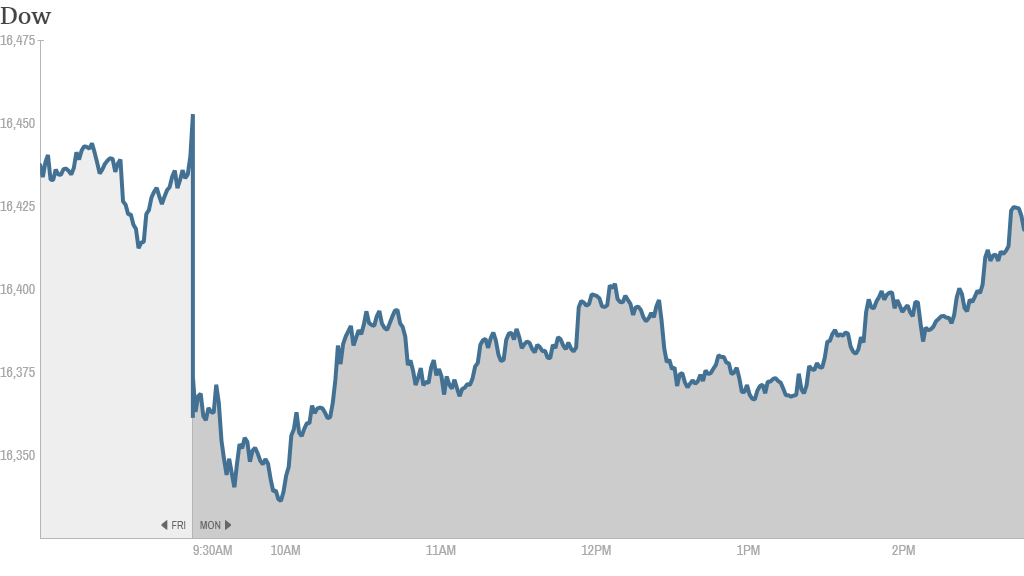

The Dow trimmed a loss of over 100 points earlier in the day, but still ended slightly in the red. The S&P 500 and Nasdaq finished flat.

The Dow and S&P 500 are near all-time highs as investors celebrated the five year anniversary of the current bull market.

But the Nasdaq is not back to all-time highs yet.

In fact, Monday is the 14-year anniversary of the tech-heavy index hitting its peak of above 5,130.

Still, the Nasdaq is now only about 15.5% below its dot-com boom record, thanks to a nearly 40% jump last year and strong start to 2014.

European markets closed mostly in the red. And Asian markets ended significantly lower after China trade data and revised Japanese GDP numbers came in weaker than expected.

Boeing (BA) shares fell after Malaysia Airlines Flight 370, a Boeing 777, disappeared Saturday in mysterious circumstances en route to Beijing. The company also announced late Friday that "hairline cracks" had been found on some of its Dreamliner 787 jets still in production.

Related: Winners and losers of the bull market

But one trader on StockTwits thought the stock's dip might be short-lived.

"$BA I wonder if BA jumps right back up after all this bad news," said bluegill1972. "I'm thinking this might be a buy soon."

Tension in Ukraine created volatility in global markets early last week. But investors have been breathing a sigh of relief the past few days as the crisis seems to be abating.

"As long as there's no feeling that an escalation into a wider conflict is imminent, the markets may remain calm," said Wasif Latif of USAA Investments in a note to clients Monday morning.

Related: Fear & Greed Index is in extreme greed

In other corporate news, Chiquita Brands (CQB) rallied more than 10% after the company said it was buying Ireland's Fyffes for about $526 million to create the world's leading banana company.

Shares of 3-D printer maker DDD Systems (DDD) plunged 5% after a report over the weekend claimed that investors may be overpaying for 3-D printing stocks. The stock is down around 30% this year after a huge run in 2013.

But StockTwits user johnnyquest felt that the report was "shortsighted" and that 3-D printing technology will continue to grow. "$DDD The law of accelerating returns will prevail in 3d printing. We'll be printing our wardrobes soon," he said.

LowRiskTrader echoed that sentiment. "$DDD ...Every sell off is a reason to buy," he said.

Shares of eBay (EBAY), a member of CNNMoney's Tech 30 Index, slumped after Carl Icahn stepped up his campaign against the company's management.

In a letter Monday, the activist investor attacked John Donahue, the company's CEO, for failing to supervise his firm's board for alleged conflicts of interest related to their financial stakes in companies that Icahn believes are eBay competitors. eBay responded by defending Donahue's record. Icahn wants eBay to spin off its PayPal unit.

"$EBAY board. When will you guys learn. Mr. Icahn always gets his way," quipped tonytan0 on StockTwits.