It's going to be a big day.

The official U.S. jobs report is coming out, and the data often has a big effect on investor sentiment and market direction.

Here are the four things you need to know before the opening bell rings in New York:

1. Jobs, jobs, jobs: The U.S. Department of Labor will post its monthly jobs report at 8:30 a.m. ET. Economists surveyed by CNNMoney expect that 200,000 jobs were created in June, down from 217,000 in May.

But paycheck processor ADP (ADP) said Wednesday that private-sector payrolls grew by 281,000 in June, far exceeding expectations. That report suggests Thursday's tally, which includes government jobs, could exceed 200,000.

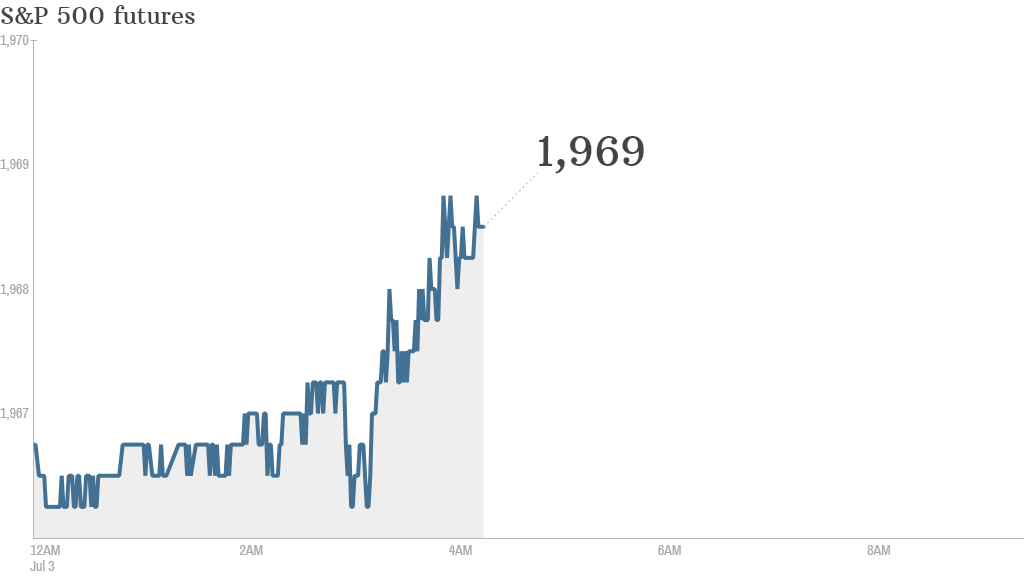

2. Markets in neutral: U.S. stock futures were flat ahead of the beginning of a shortened session Thursday. Markets close at 1 p.m. today, and will remain shut Friday for the July 4th holiday.

The Dow Jones Industrial Average rose to a record high Wednesday, but is still about 24 points below 17,000 -- a level of greater psychological than technical significance. The S&P 500 narrowly surpassed its record high as well, and now sits at 1,974.6. The Nasdaq inched lower.

A strong jobs number could see the main indexes push onto new records.

The latest reading from the CNNMoney Fear & Greed index shows investors are feeling extremely greedy.

3. Draghi speaks: The European Central Bank holds its regular monthly interest rate-setting meeting, and news conference. Markets are expecting no change in policy after the ECB cut rates to record lows last month as part of a package of measures aimed at heading off the risk of deflation.

Still, investors will be paying close attention to President Mario Draghi's remarks for any sign of the ECB moving closer to a comprehensive Fed-style program of asset purchases.

4. International markets overview: All major European markets managed gains of about 0.3% in early trading. Asian markets ended with muted results.

The biggest standout performer was the Australian stock market -- the Australia ASX All Ordinaries index closed with a gain of 0.7%.