Don't blink. Otherwise you're bound to miss a wild swing in this increasingly-violent stock market.

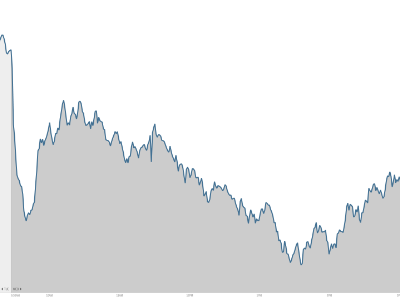

It was a memorable day on Wall Street as the Dow plummeted 460 points before staging a late rally to end down "only" 173 points. The Nasdaq briefly fell into correction territory, indicating a 10% drop from a prior high, but rebounded sharply to finish the day barely in the red.

"It was an emotion and panic-filled day both in and out of assets. You flushed out a lot of panicked longs and you're getting a knee-jerk bounce. What this means going forward, I don't know," said Peter Boockvar, chief market analyst at The Lindsey Group.

Late-day heroics: The factors behind the early losses were obvious and plentiful: slow economic growth, rising Ebola fears and continued uncertainty about the Federal Reserve. The reasons for the rebound were less clear, though beaten-down stock prices appeared to entice buyers to step off the sidelines.

Just look at the Nasdaq, which closed a whopping 2.4% above its low point for the day.

The Russell 2000, a basket of small-cap stocks that has recently taken a big hit, actually rallied over 1% Wednesday.

"$SPY $QQQ impressive comeback from the bottom," StockTwits user Zachi wrote.

Despite the late-day heroics, the recent slide on Wall Street has wiped out a whopping $1.5 trillion of market value from the S&P 500, according to S&P Dow Jones Indices.

Fear continues to grip the stock market. This week CNNMoney's Fear & Greed Index has tumbled to zero, indicating "extreme fear," for the first time since 2011.

As investors flee risky assets like stocks, they are rushing into U.S. government bonds, which are seen as safe havens during times of market stress. The yield on the 10-year Treasury broke below 2% on Wednesday for the first time since mid-2013.

"We have a really toxic cocktail of negatives" that are "conspiring to put pressure on the markets," said Art Hogan, chief market strategist at Wunderlich Securities.

Related: Investors love U.S. bonds right now

The hardest hit stocks: The market has been jittery the past few weeks because Europe, especially Germany, isn't doing well. But now there is concern about the U.S.

Retail sales unexpectedly shrank last month for the first time since January, according to a government report this morning. Retailers like Macy's (M), Home Depot (HD) and J.C. Penney (JCP) dropped sharply on the news.

Also a new report showed inflation at the producer level dipped for the first time in over a year. Shrinking prices are not a sign of a healthy economy.

"People are truly frightened about the global growth picture," said John Canally, chief economist strategist at LPL Financial.

Related: Crashing oil prices could crush Vladimir Putin

American Airlines (AAL) and Delta Airlines (DAL) dropped early in the day as word spread that the new Ebola patient flew the day before being diagnosed. Other travel stocks like Carnival (CCL) cruise line and Hilton Worldwide (HLT) were also being hit as investors fear further fallout.

Close to a correction: Many market watchers believe a correction (a 10% decline from previous high) is long overdue. Such a downward move could even be healthy because it could lure in buyers who have been waiting on the sidelines for cheaper prices.

"Now is actually an attractive entry point for many investors," Merrill Lynch Wealth Management wrote in a note on Wednesday. "For investors who aren't used to the feel of turbulence, it's a reminder that this is the just fourth market pullback of 5% or more in two years (whereas the historical average is about three times a year)."

The S&P 500 hasn't suffered a correction since the one that ended in October 2011. To put that in perspective, Hollywood has had time to churn out three different Xmen movies over that span.

Related: Ebola is spooking Wall Street

The S&P 500 needs to close below 1,810 to be in correction territory, based on its September 18 closing high of 2,011.36. It traded as low as 1,820 on Wednesday before ending at 1,862.

The Nasdaq slipped under 4,138 -- its correction level -- briefly today before rebounding to close at 4,215.

The Dow isn't far off from correction status either. It would need to dip below 15,552, compared with its close of 16,142.

All three major indexes remain far from bear market status. That more serious condition indicates a 20% decline from a previous high. Wall Street hasn't had a bear market since the financial crisis, though it came close during the last correction.