It's been a thoroughly exciting week in the markets, and it's not over yet.

Here are the five things you need to know before the opening bell rings in New York:

1. Nasdaq set for another record?: It looks like the Nasdaq could hit new all-time highs Friday. The tech-heavy index finished Thursday with a 1% gain.

The Nasdaq will have to surpass the level 5,164.36 to reach a new record.

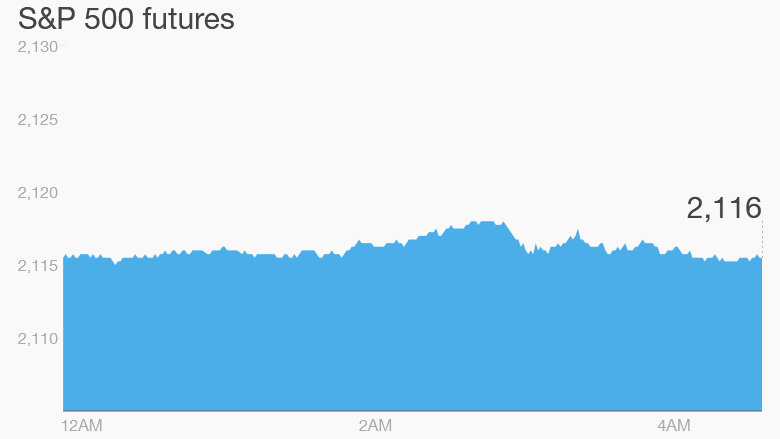

U.S. stock futures are mixed ahead of the open, with the Nasdaq indicating it will keep rising while the Dow Jones industrial average and S&P 500 could post small declines.

2. Earnings: General Electric (GE) and Honeywell (HON) are reporting ahead of the open.

Telecoms firm Ericsson (ERIC) reported second quarter results earlier in the morning and shares are rising by about 6% in Europe.

Shares in Google (GOOGL) are set to surge by about 11% this morning after the tech giant reported better-than-expected results on Thursday evening.

3. Germany votes on Greek bailout: Germany's parliament -- the Bundestag -- is voting Friday on whether to support formal negotiations on a new Greek bailout, which was agreed in principle by eurozone leaders earlier this week.

"[German Chancellor Angela] Merkel has enough votes to ensure passage, but there may be interest in the level of dissent expressed vocally or in votes," said Paul Donovan, a senior economist at UBS.

Many Germans hate the idea of lending Greece more money after years of overspending and political mismanagement.

4. International markets overview: European markets are slipping a bit lower in early trading, while most Asian markets ended with strong gains.

5. Economics: The U.S. Bureau of Labor Statistics is releasing June inflation data at 8:30 a.m ET.

The Census Bureau is releasing the latest monthly data on housing starts and building permits at the same time, to give the markets a better idea about the health of the American housing market.

Then at 10 a.m. the University of Michigan is releasing its latest consumer sentiment reading for July.