China, Fed, the Volkswagen scandal -- All of these are leaving investors dazed and confused.

The Dow tumbled 180 points Tuesday. The S&P 500 declined 1.2% and the Nasdaq retreated 1.5%.

"Dazed and confused" is the overriding sentiment in markets, according to Tom Stringfellow, chief investment officer at Frost Investment Advisors.

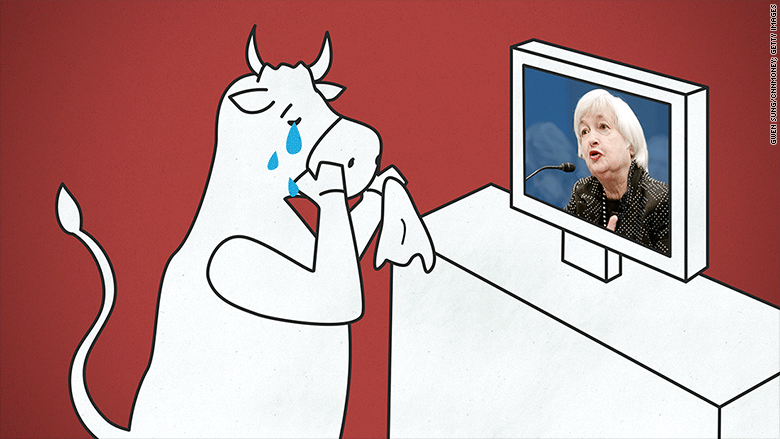

Wall Street is certainly starting to get "Fed" up with lingering confusion and the lack of clarity on when the Fed will lift interest rates from 0% and why it didn't happen last week.

Top Fed officials have been giving speeches and media interviews trying to explain the reasoning behind the decision. However, all of it seems to have confused investors even more.

Related: These comments are causing stock uncertainty

"Investors are still reeling and in a state of confusion in regards the Fed's outlook for the economy and timeline for normalization," veteran market watcher Peter Kenny, an independent market strategist and founder of Kenny's Commentary, wrote in a note.

Things were almost a lot worse on Tuesday. At one point the Dow was down 288 points before the markets rebounded slightly. Still, the losses were enough to return the Dow to "correction territory," signifying a decline of at least 10% from previous highs. The S&P 500 and Nasdaq are nearly back to correction mode as well.

Related: Is the stock market holding Janet Yellen hostage?

Fed frustration mounts

The Fed decision perplexed investors because it sent mixed signals. The central bank cited global developments (code: China) and market turbulence for keeping rates steady.

Fed chief Janet Yellen mentioned China and global concerns several times when she talked to reporters about the central bank's decision. Her comments suggested the Fed was placing more weight on market turbulence and China than is historically normal.

Confusion mounted as Fed officials fanned out to explain the decision. Officials including Dennis Lockhart, Jeffrey Lacker and James Bullard sounded more aggressive about raising rates than Yellen, citing recent improvements in the economy.

All of this has left investors scratching their heads.

"Yellen was dovish and yet four of her colleagues on the Fed have come out and sounded more hawkish and no one knows what to expect," Michael Block, chief strategist at Rhino Trading, wrote in a note to clients.

"The dithering and mixed messages are not bullish or helpful at all. We should remain under pressure here," Block wrote.

Volkswagen scandal knocks auto, European stocks

Meanwhile, European stock markets plunged 3%, slammed by similar concerns and a massive emissions scandal that is enveloping one of the world's largest car makers.

Volkswagen (VLKAF) stock plunged another 17% in Europe after a breathtaking 20% drop on Monday.

Investors fear the fallout could spread. Shares of Fiat Chrysler (FCAU) slumped 6%, Ford (F) declined 3% and General Motors (GM) retreated 2%.

Auto parts makers were also being squeezed. Tenneco (TEN) and BorgWarner (BWA), each of which make emissions control products, plunged about 8% apiece.

Related: What Volkswagen means to the German economy

Clinton-fueled biotech backlash

Also in the U.S., biotech stocks remain under pressure following Hillary Clinton's promise to take on alleged "price gouging" by drug makers.

The iShares Nasdaq Biotechnology ETF (IBB) slid 1.5% after tumbling 5% on Monday. Big losers include Vertex Pharmaceuticals (VRTX) and Mylan (MYL).

Goldman Sachs (GS) stock also fell 2% after the company revealed that its CEO Lloyd Blankfein has cancer.