Markets are under intense pressure today.

Here are the five things you need to know before the opening bell rings in New York:

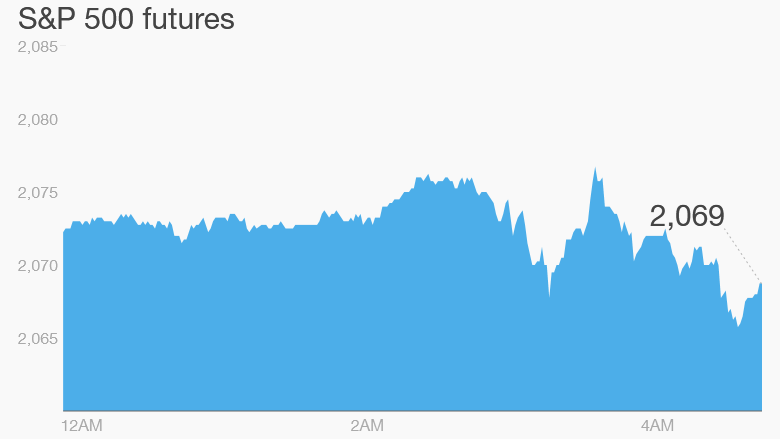

1. Weak China data hits stocks and commodities: U.S. stock futures are dipping by about 1% and all key market indexes across Europe and Asia are in the red.

This follows a weak economic report out of China that shows imports and exports continued to fall last month. The yuan-denominated value of exports from China fell 3.7% in November, marking the 13th consecutive monthly decline. And imports fell for a fifth straight month, down by 5.6%, according to official data.

This is putting pressure on mining and commodity companies. Shares in Rio Tinto (RIO), Glencore (GLNCY) and Anglo American (AAUKF) are all sinking by 6% to 10% in London as traders expect Chinese demand will continue to wane.

Anglo American shares have been hit particularly hard after the company said Tuesday it's going to shrink its business and suspend its dividend.

Crude oil, natural gas, copper, iron ore and aluminum are trading around some of the lowest levels they've seen in years. The S&P Goldman Sachs Commodity index has declined by 24% since the start of 2015 and is now trading near recession levels set in early 2009.

2. Recession? Nope: It turns out Japan is not in a recession. Gross domestic product grew by an annualized 1% in the third quarter, instead of contracting by 0.8% as previously estimated.

That means the world's third-largest economy has dodged a second consecutive quarter of economic contraction.

Japan's GDP data is often revised but this shift from a negative reading to positive growth is an unusually large change.

3. Earnings to watch: One of the most widely watched earnings reports today will come from gun manufacturer Smith & Wesson (SWHC) after the close.

Its shares have surged 116% this year, in part because investors expect gun fanatics will go on a buying spree as they worry that U.S. gun rules could get tighter.

Gun stocks have been rallying since the December 2 terror attacks in San Bernardino that killed 14 people. Shares in Sturm, Ruger (RGR) are up 66% year-to-date.

Other companies reporting earnings include Costco (COST) and Krispy Kreme (KKD).

It's also worth watching Home Depot (HD) as it hosts a conference call with investors and analysts at 9 a.m. ET. The company is expected to lay out a three-year business plan.

Related: How easy is it to buy a gun in these countries?

4. Concern brews over Bud-Miller merger: The U.S. Senate is holding an anti-trust hearing at 10 a.m. to review the planned takeover of SABMiller (SBMRY) by Anheuser-Busch InBev (AHBIF). There are concerns about how the merger of the two largest beer brewers in the world could hurt competition in the sector.

AB InBev CEO Carlos Brito will be among the executives that are testifying.

5. Monday market recap: The Dow Jones industrial average and S&P 500 both dipped by 0.7% over the previous trading day. The Nasdaq sank by 0.8%.