It's going to be a big day for Dow Chemical and DuPont as reports swirl that the chemical firms are considering a $120 billion merger.

Here are the five things you need to know before the opening bell rings in New York:

1. Dow + DuPont: Shares in Dow Chemical (DOW) and DuPont (DD) are soaring by about 10% premarket after the Wall Street Journal and Financial Times reported that the companies are in talks about a massive merger.

The Wall Street Journal and Financial Times reported overnight that the chemical companies are talking about combining their operations, then splitting themselves up again into three separate businesses. The reports cited unnamed people familiar with the negotiations.

Both firms declined to comment on what they described as "rumors and speculations."

2. Market movers -- Yahoo, Smith & Wesson: Shares in Yahoo (YHOO) are rising by about 2% premarket after Yahoo's board announced it would not spin off its Alibaba (BABA) stake as previously planned. Instead, it is thinking about a reverse spin-off -- transferring the group's other businesses to a new company, and distributing shares to investors.

Yahoo has a 15% share in Chinese e-commerce giant Alibaba, worth about $30 billion. The company halted the Alibaba spin-off plan due to concerns about a gigantic tax bill of about $10 billion.

The tech pioneer has been lumbering through an attempted turnaround and has been weighing its next steps.

Shares in gun manufacturer Smith & Wesson (SWHC) are looking weak premarket after the firm reported earnings on Tuesday that showed quarterly sales were up 32% from last year.

While the results were impressive, investor reaction was tepid since the company's shares have already surged by 126% this year.

Shares in gun stocks such as Smith & Wesson and Sturm, Ruger (RGR) have rallied in 2015 following mass shootings. Gun fanatics have been buying more firearms as they worry that gun control rules could tighten.

3. Oil prices regain lost ground: Crude oil futures have recovered a bit after hitting recession-era levels below $37 per barrel on Tuesday.

Crude is now trading around $38 a barrel.

A massive supply glut has wiped out two-thirds of oil's value after it peaked at roughly $108 a barrel in June 2014.

Related: 'Markets are falling apart,' says Jeff Gundlach

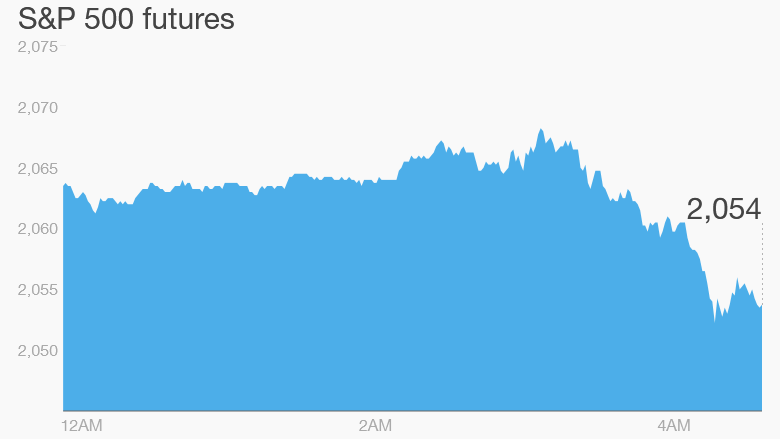

4. Stock market overview: U.S. stock futures are looking soft and most European markets are in negative territory in early trading.

This comes after most Asian markets tumbled on Wednesday and closed in the red.

Tuesday was also a weak day for stocks. The Dow Jones industrial average dipped 0.9%, the S&P 500 dropped 0.7% and the Nasdaq edged down by 0.1%.

5. Earnings: There are a few high-profile retailers reporting quarterly results Wednesday.

Lululemon (LULU) is reported ahead of the open while Men's Wearhouse (MW) is reporting after the close.