Oil prices are dictating market sentiment yet again.

Here are the four key things you need to know before the opening bell rings in New York:

1. Crude talk: Oil futures had surged by about 5% overnight but most of those gains have now been erased following a high-level meeting between the world's biggest oil exporters in Doha, Qatar, on Tuesday.

Traders were hoping that the oil heavyweights might agree to cut production. Instead, a source in the meetings said Saudi Arabia, Russia, Venezuela and Qatar simply agreed to freeze production levels.

There is a severe oversupply in the oil market right now, which has caused prices to crash by about 70% since 2014.

Crude oil futures are currently trading around $30 per barrel.

Saudi Arabia, Russia and the U.S. are the three biggest oil producers in the world.

The U.S. government does not take part in these production talks because it does not have any direct control on the output of its thousands of producers.

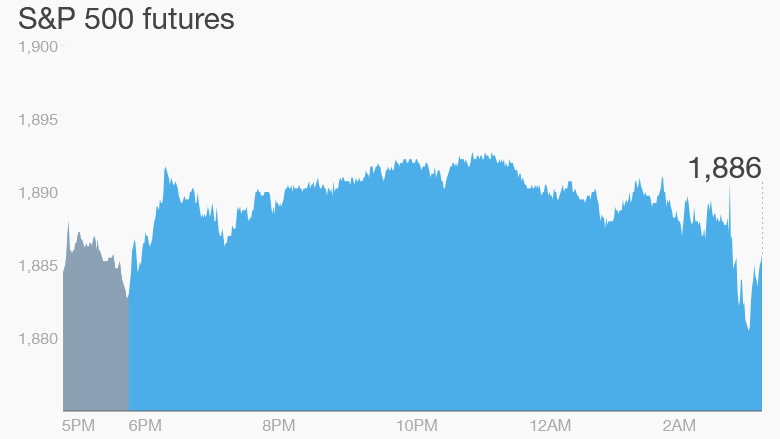

2. Stock market overview: U.S. stock futures are rising by just over 1%, playing catch-up to other international markets that were rallying on Monday. The markets had looked even perkier earlier in the morning as oil prices were up, but the enthusiasm has faded a bit.

European stock markets had also been rising in early trading and tracking oil prices, but many indexes have now dipped into the red.

Unsurprisingly some of the main market movers right now are oil companies. Shares in London-traded BP (BP) and Royal Dutch Shell (RDSB) are jumping by about 3%, though they had been higher earlier in the day.

3. Earnings: The parent company of Burger King and Tim Hortons -- Restaurant Brands International (QSR) -- is reporting earnings ahead of the opening bell, alongside Hormel Foods (HRL) and Build-A-Bear Workshop (BBW).

After the close, investors will hear from Express Scripts (ESRX), Fossil (FOSL) and Cheesecake Factory (CAKE).

London-traded Anglo American (NGLOY), one of the world's largest mining companies, released annual results for 2015 showing a $5.5 billion pre-tax loss. The company has been cutting costs as it tries to cope with lower commodity prices. The annual results come a day after Moody's cut Anglo's debt rating from investment grade to junk, citing a "deterioration in commodities market conditions."

4. Weekly market recap: Investors endured a bumpy ride last week but ended on a high note.

The Dow Jones industrial average rose by 2% on Friday, though the index is still down 8.3% in 2016. The S&P 500 jumped 1% on Friday and the Nasdaq added 1.7%.