Oil prices continue rallying Monday, but stock markets are moving in the opposite direction.

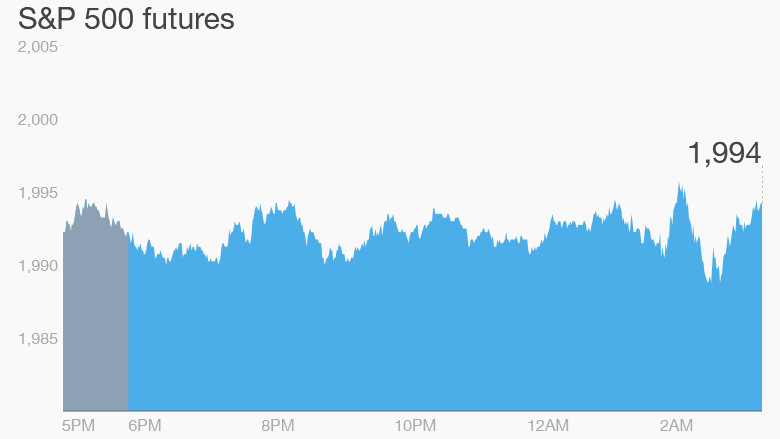

U.S. stock futures are dipping into negative territory.

Here are the five things you need to know before the opening bell rings in New York:

1. Gushing oil: Crude oil futures are rising by about 2%, trading around $36.50 per barrel.

Oil prices have risen by roughly 40% since February 11, erasing nearly all the losses seen earlier this year.

Stocks have been heavily correlated with oil over the past few months, but the link isn't so evident Monday.

Nearly all European markets are in the red in early trading, and Asian markets ended the day with mixed results.

2. China in the spotlight: Economists and investors are closely monitoring developments in Beijing, where China's annual National People's Congress is taking place.

The Chinese government this weekend set an economic growth target range of 6.5% to 7% for this year. The lower end of the range marks a slowdown from previous years when the country experienced breakneck growth rates.

Related: Economists warn of risks from negative interest rates

3. Stock market movers -- DuPont, Fastjet: Shares in DuPont (DD) are rising in extended trading after Bloomberg reported that Germany's BASF (BASFY) is considering making a bid for the company.

DuPont agreed in December to a multi-billion dollar merger with Dow Chemical (DOW). It looks like BASF is trying to spoil the party.

Shares in African low-cost airline Fastjet are plunging by about 35% in London trading after the company warned it would deliver worse-than-expected results in 2016.

"The group no longer expects to be cash flow positive for the year," it said in a statement, adding that it may have to raise cash from investors.

4. Earnings: Burger chain Shake Shack (SHAK) and retailer Urban Outfitters (URBN) are reporting earnings after the close.

5. Weekly market recap: March has begun with a bang.

The main market indexes have been rallying since the beginning of the month, and over the course of last week the Dow Jones industrial average rose 2.2%, the S&P 500 jump 2.7% and the Nasdaq grew 2.8%.