Investors are selling stocks and piling into bonds Tuesday.

Here are the five things you need to know before the opening bell rings in New York:

1. Stocks to watch -- Allergan, Tesla, Disney: Shares in drugmaker Allergan (AGN) are crashing premarket after the U.S. Treasury announced it is cracking down on companies that try to reduce their tax bills by merging with foreign firms.

Pharma giants Pfizer (PFE) and Allergan announced late last year that they would combine in a blockbuster deal that might help Pfizer save money on its tax bill. These types of deals are called "inversions".

Tesla (TSLA) shares are also sinking premarket after the automaker said it sold fewer cars than expected in the first quarter.

Disney (DIS) shares could be under pressure Tuesday after Thomas Staggs, the heir apparent to CEO Bob Iger, abruptly announced he was leaving the firm. In a statement, Disney said it would "broaden the scope of its succession planning process."

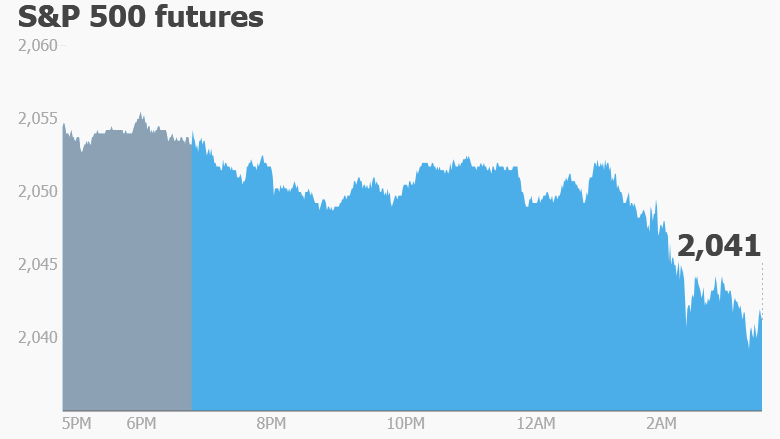

2. Global market overview: U.S. stock futures are sinking and every major market index in Europe is trading lower.

Germany's Dax index is dropping by just over 2% as investors react to a dismal report showing factory orders in the country slumped in February.

Most Asian markets were also in the red Tuesday, but the Shanghai Composite managed to stay in positive territory.

Meanwhile, investors bought government bonds and gold as they sought a safe haven amid the selling.

Crude oil futures are weakening further to trade around $35.50 per barrel. Oil prices have been trading at depressed levels for over a year. Prices had exceeded $100 per barrel back in the summer of 2014.

Related: 20 stocks poised to crush earnings season

3. Earnings: The key companies scheduled to report earnings this morning are Walgreens (WBA) and Darden Restaurants (DRI), which owns Olive Garden.

4. Economics: The U.S. Census Bureau will report the country's trade balance for the month of February at 8:30 a.m. ET. In January, the U.S. trade deficit widened to $45.7 billion.

The Institute for Supply Management will update its services index with March's number at 10 a.m.

India's central bank slashed interest rates on Tuesday, delivering a stimulus jolt to the world's fastest-growing large economy.

The Reserve Bank of India cut the rate at which it lends to banks by 0.25 percentage points to 6.5%, its lowest level in five years.

5. Monday market recap: The Dow Jones industrial average and the S&P 500 each dipped 0.3%, and the Nasdaq shed 0.5%.