Welcome to Thursday.

Here are the five things you need to know before the opening bell rings in New York:

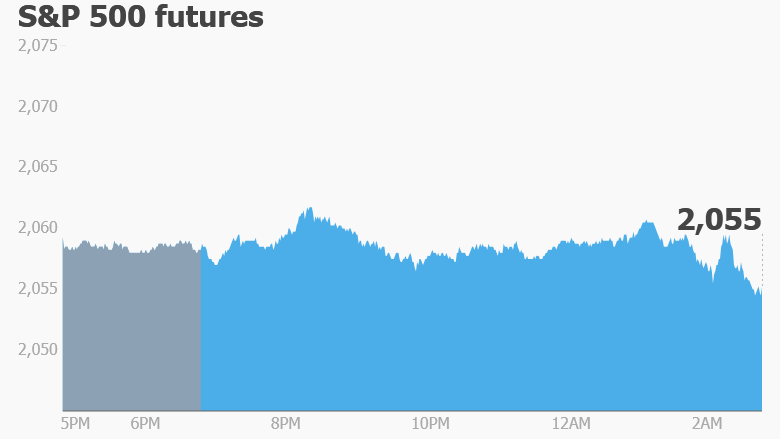

1. Global market overview: U.S. stock futures are slipping lower, and international markets are muddling along, with no clear catalyst to set direction.

Oil and gold prices are steady, with oil trading around $38 per barrel.

In the currency market, the British pound continues to dip as traders remain concerned about uncertainty related to the upcoming EU referendum in June. The pound has fallen this year versus every major currency in the world.

2. Companies to watch -- Yahoo, Tesla: Yahoo (YHOO) may face extra scrutiny Thursday following a Re/code report saying company documents show the tech giant has been in "a serious free fall."

Yahoo's revenue is expected to drop 15% and earnings could decline more than 20%, according to the report.

Tesla (TSLA) is also in the spotlight as CEO Elon Musk promised to reveal the latest order figures for the company's new Model 3 electric car. Orders for the sedan have far exceeded expectations.

Related: Most Tesla Model 3 buyers won't get the $7,500 tax break

3. Stock market movers -- ZTE, Takata: Shares in Chinese tech giant ZTE Corporation fell by as much as 15% on Thursday as investors reacted to a management overhaul, disappointing financial results and a warning from the company that it could face charges in the U.S.

ZTE shares had been suspended since early March, when the smartphone and telecoms equipment maker was accused of violating U.S. trade rules.

Shares in troubled auto parts company Takata shifted lower Thursday after another one of its faulty airbags was blamed for the death of a driver in Texas.

This fatality brings the known death count in the U.S. to 10, according to Clarence Ditlow, executive director of the Center for Auto Safety.

The company has been conducting a massive recall of its airbags.

Related: Prepare for the worst earnings season since the Great Recession

4. Earnings and economics: ConAgra (CAG), Rite Aid (RAD) and CarMax (KMX) are set to release their quarterly earnings ahead of the opening bell.

Investors will also get employment data to digest this morning at 8:30 a.m. ET when the Department of Labor releases its weekly jobless claims report.

5. Wednesday recap: Wall Street rallied on Wednesday and ended the day in positive territory.

The Dow Jones Industrial Average jumped by 0.6% to end at 17,716 points. The S&P 500 was up 1.1% to close at 2,067, and the Nasdaq rallied by 1.6%.