It's shaping up to be a very interesting day.

Here are the six things you need to know before the opening bell rings in New York:

1. Trouble at Mitsubishi: Shares in Japanese automaker Mitsubishi Motors tumbled 15% in Tokyo after the company said it had rigged fuel efficiency tests.

Mitsubishi's announcement follows a huge scandal that rocked German auto giant Volkswagen (VLKAY) last year after it admitted to rigging diesel engine emissions tests in America and Europe.

2. Tech talk -- Intel, Yahoo, Google: A number of major U.S. tech companies are in the spotlight Wednesday.

Intel (INTC) announced late Tuesday that it plans to cut up to 12,000 people from its staff globally, or about 11% of its workforce.

Yahoo (YHOO) reported its first quarter earnings on Tuesday after the closing bell and it's wasn't a pretty sight. Yahoo posted a big loss, and sales fell by double digits. CEO Marissa Mayer has been looking at selling the company after making little progress in turning around the company's fortunes over the past four years.

Google (GOOGL) is facing a huge fine and major disruption to the way it does business after European officials filed new antitrust charges against the company.

The European Commission said Google was abusing its market position by imposing restrictions on Android device manufacturers and mobile network operators.

Google's Android is the world's dominant mobile operating system.

3. Earnings: A wave of quarterly earnings are coming through Wednesday.

Coca-Cola (KO), DISH Network (DISH), Tupperware (TUP) and U.S. Bancorp (USB) are among the key companies reporting before the open.

American Express (AXP), Mattel (MAT), United Continental (UAL) and Yum! Brands (YUM) are reporting after the close.

And shares in ARM Holdings (ARMH) are rising in London after the high-tech chip designer posted results that were well received.

Related: 20 stocks poised to crush earnings season

4. Kuwait moving markets: Crude oil futures are down 2% after the Kuwait News Agency reported that oil workers in the country had ended a three-day strike.

Kuwait's oil production reportedly slowed significantly during the stoppage.

Oil prices could remain volatile Wednesday as the U.S. Energy Information Administration reports weekly crude oil inventory data at 10:30 a.m. ET. The U.S. has been storing much more crude than usual and traders could continue pushing prices down if the data shows that inventory levels continue to rise.

"If we do not see a big drawdown in the inventory numbers, the sell-off could become intense," said Naeem Aslam, chief market analyst at Ava Capital Markets.

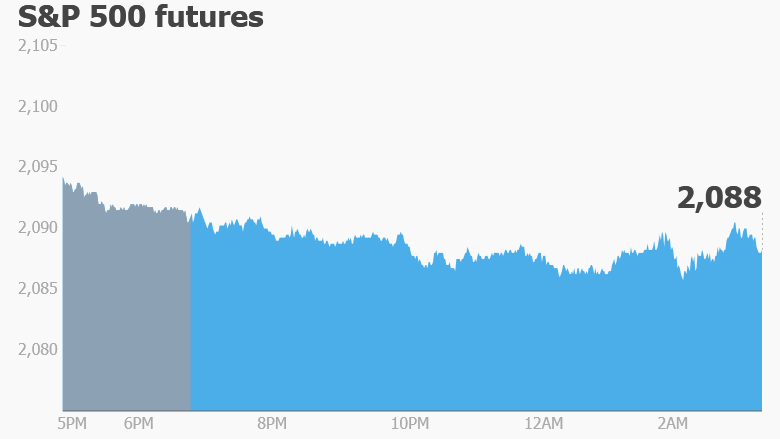

5. Global market overview: U.S. stock futures are looking soft and European markets are rather weak in early trading.

Chinese stock markets ended the day with losses, though trading across the rest of Asia was much more muted.

Investors seem to be tucking their money into 10-year government bonds in the U.S. and Europe, which is causing yields to slip.

6. Tuesday market recap: The Dow Jones industrial average and S&P 500 pushed to fresh closing highs for 2016 on Tuesday. Each of the indexes edged up by 0.3%. But the Nasdaq declined by 0.4%.