Welcome to Monday.

The term #mondaymotivation is trending on Twitter (TWTR) right now. It certainly looks like investors could use some of that this morning.

Here are the four things you need to know before the opening bell rings in New York:

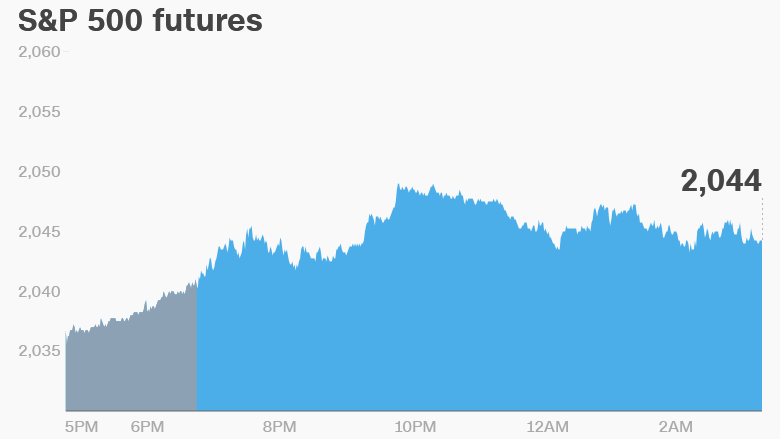

1. Monday market overview: U.S. stock futures are not making any major moves ahead of the open following a third straight week of losses on the key indexes.

Last week the Dow Jones industrial average fell 1.2%, the S&P 500 slipped 0.5% and the Nasdaq dropped 0.4%.

"The last time the [Dow] registered three consecutive weekly losses was at the start of the year. Needless to say, the damage was far more severe then," said Mike O'Rourke, chief market strategist at JonesTrading.

The majority of European markets are dropping in early trading, while most Asian markets ended the day with gains.

2. Potential market mover -- Yahoo: Shares in Yahoo (YHOO) could pop at the open as it emerged over the weekend that an investing group backed by Warren Buffett is among the bidders for Yahoo's core Internet business.

A Buffett-backed bid could challenge Verizon's (VZ) status as the most likely buyer of the business. Verizon has been expanding into digital content and advertising and last year bought AOL for more than $4 billion.

Related: The world's top oil producers

3. Crude reality: Crude oil futures are trading around $47 per barrel. The last time oil traded at this level was just over six months ago.

Prices are rising Monday in reaction to a Goldman Sachs (GS) report that says oversupply in the market has come to an end due to "sustained strong demand as well as sharply declining production."

Crude prices have been recovering since hitting a historic low around $26 per barrel in mid-February.

4. Economics: The National Association of Home Builders will release its housing market index for May at 10 a.m. ET.