It's Tuesday. And things are looking up!

Here are the four things you need to know before the opening bell rings in New York:

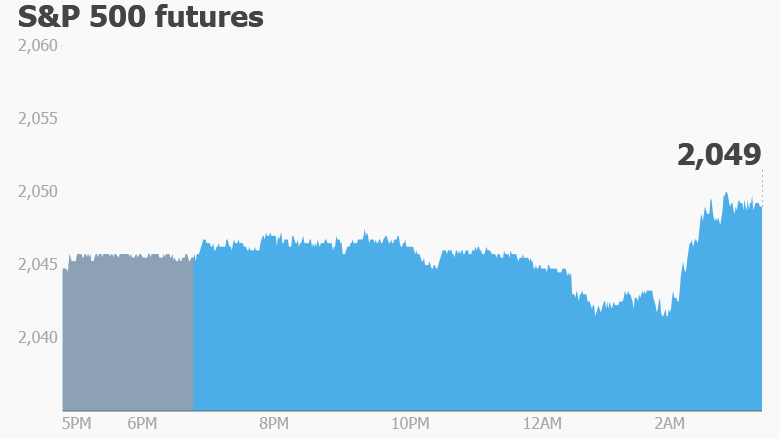

1. Time for a rally?: U.S. stock futures are pointing up and European markets are jumping in early trading.

A negative mood in the market evaporated after new data showed Germany's economy grew by 1.3% in the first quarter compared to the same time last year.

"The German GDP data matched the forecast level and this has changed sentiment among traders," explained Naeem Aslam, chief market analyst at ThinkForex.

Asian markets ended the day with small losses.

The last few trading days have been relatively uneventful and volatility is low. The CBOE Volatility Index is currently half the level it was in late January when markets were extremely volatile.

On Monday, the Dow Jones industrial average and Nasdaq dipped 0.1% while the S&P 500 declined 0.2%.

2. Earnings and economics: Best Buy (BBY) and AutoZone (AZO) are among the key companies reporting earnings before the bell Tuesday.

Hewlett Packard Enterprise is reporting results after the close.

On the economic front, the U.S. Census Bureau will issue its new home sales data at 10 a.m. ET.

3. Another auto recall: Shares in Toyota (TM) dropped 1.4% in Japan after the automaker said it would recall an additional 1.6 million vehicles in the U.S. due to airbag safety issues. This airbag issue affects tens of millions of cars with defective Takata parts.

Faulty airbags made by the company have exploded, firing out shards of metal that have caused injuries and deaths.

Shares in Takata (TKTDY) have dropped by about 75% since late last year as the airbag recall grows.

4. Beer merger: The European Commission could decide Tuesday whether to allow Anheuser-Busch InBev (AHBIF) to buy SABMiller (SBMRY) for about £68 billion ($99 billion).

The marriage of the King of Beers and the owner of Pilsner Urquell is dependent on the two companies selling off several brands to satisfy antitrust regulators.

If completed, it would be the biggest beer deal ever and among the largest acquisitions of all time.