1. Facebook takes a fall: Shares in Facebook (FB) are falling by about 7% premarket after CFO David Wehner spooked investors yesterday by warning that sales growth was expected to slow in 2017.

Sales hit a new record in the third quarter, but Wehner's comments indicate the boom may be ending.

Facebook's remarkable sales growth has been fueled by its success in selling ads on smartphones and tablets. Mobile ads now account for 84% of overall ad revenue, compared to almost nothing in mid-2012.

Another tech company that's set to take a big fall Thursday is Fitbit (FIT). The wearable device maker's stock is down by about 30% in extended trading following a disappointing earnings report.

2. Extreme fear is back: CNNMoney's Fear and Greed index suggests investors are feeling extremely fearful right now as the U.S. election looms.

The market's key volatility gauge, the VIX (VIX), has crept up to the highest levels since the aftermath of the Brexit shock in June.

Veteran market observers blame politics for the fear on Wall Street, pointing to new polls that suggest Donald Trump's chances of winning the White House have risen.

"A Trump presidency strikes fear in a large percentage of investors," according to a report from Bespoke Investment Group. "As his odds have risen over the last few days, the market has sold off."

The S&P 500 fell on Wednesday for the seventh day in a row, hitting a four-month low. The Dow Jones industrial average and Nasdaq have also sustained a string of losses for the last few years.

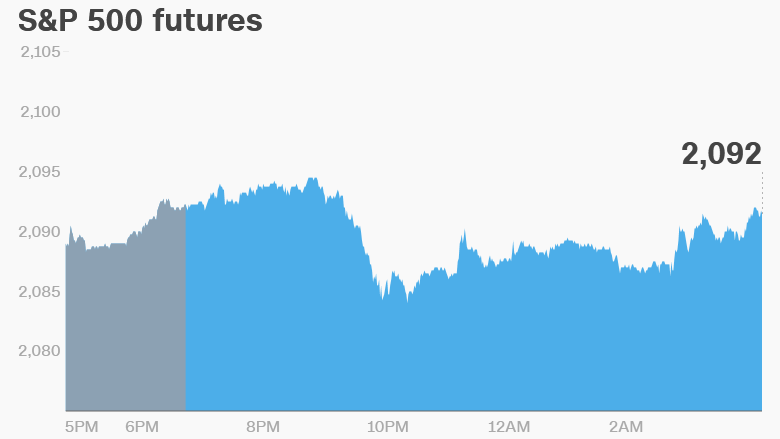

However, U.S. stock futures are not looking too poorly right now. They're slipping a tad, but it's nothing dramatic.

Meanwhile, European and Asian markets are showing mixed results.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Earnings: Adidas (ADDYY), Avon Products (AVP), Chesapeake Energy (CHK), Hyatt Hotels (H) and Time (TIME) are some of the key companies releasing earnings before the opening bell.

Shares in Adidas are falling by about 4% in Europe as investors express their disappointment with the results.

Coming up, CBS (CBS), Kraft Heinz (KHC), Starbucks (SBUX), Weight Watchers (WTW), GoPro (GPRO), FireEye (FEYE) and Fossil (FOSL) are set to release their earnings after the close.

And shares in Wynn Resorts (WYNN) are dropping premarket after the company reported earnings that missed Wall Street estimates.

4. Think of England: Britain's plans to leave the European Union were thrown into confusion Thursday after a court ruled that members of parliament must be given a say in the process. The government had been fighting in court to avoid having members of parliament meddle in the Brexit negotiations.

The case will now move to the Supreme Court where the government is challenging the decision.

The Bank of England is set to issue a decision on interest rates Thursday, though market watchers are expecting the central bank will hold rates steady.

If that's the case, it will be at least the fourth major central bank in a week to hold rates, following the Federal Reserve, Bank of Japan and Reserve Bank of Australia.

5. Economics: Many of the elements that feed into the U.S. GDP report will pop up this morning, including reports on factory orders and worker productivity.

The European Union is also publishing its autumn economic forecast Thursday along with releasing new data on September unemployment levels.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Thursday - Bank of England's rate decision, CBS (CBS) and Starbucks (SBUX) earnings

Friday - Jobs report, Adidas (ADDDF) earnings, International trade report