1. High hopes for OPEC: Oil prices are surging by roughly 8% based on rising expectations that some of the world's biggest oil producers will agree to cut output during an OPEC meeting Wednesday in Vienna.

The group had agreed, in principle, to cut production in September. But now they have to sign the dotted line, which is easier said than done.

Crude oil futures are now trading around $49 per barrel.

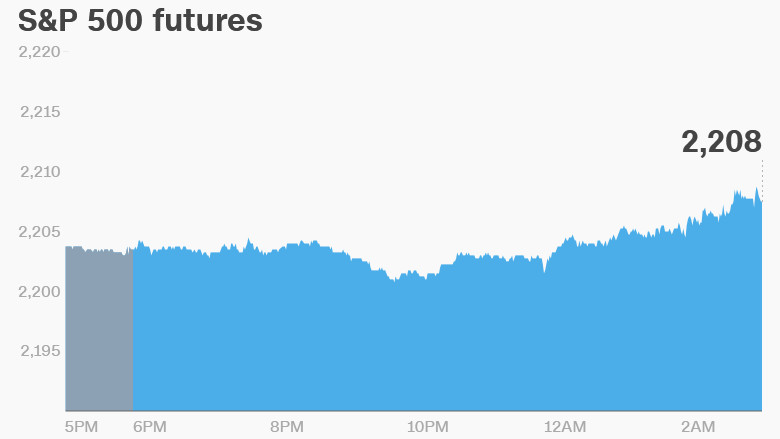

2. Global markets jump: U.S. stock futures are rising again, though the gains are rather small.

The main indexes -- the Dow Jones industrial average, S&P 500 and Nasdaq -- are not far from all-time highs.

European markets are all rising in early trading, with oil companies leading the pack.

Asian markets are closing out the day with mixed results, though the moves were rather muted.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Stress for RBS: The bank that nearly broke the United Kingdom economy is still in trouble eight years after the financial crisis.

Royal Bank of Scotland (RBS) was the worst performing major bank in stress tests performed by the Bank of England.

The bank -- which is majority owned by the state -- said it is now implementing a plan to raise an additional £2 billion ($2.5 billion) in capital to strengthen its balance sheet. Its shares were declining by about 3% on Wednesday.

British banks Barclays (BCS) and Standard Chartered (SCBFF) also fell short on some parts of the stress test.

Download CNN MoneyStream for up-to-the-minute market data and news

4. Trump appointments: President-elect Donald Trump has just appointed key members to his economic team.

Trump chose billionaire investor Wilbur Ross to be Commerce secretary

And Steven Mnuchin, a former Goldman Sachs (GS) exec turned Hollywood producer, has been named Treasury secretary.

5. Economic updates: ADP will report how many private-sector jobs were created in the U.S. economy in November at 8:15 a.m. ET.

The U.S. Bureau of Economic Analysis will release October data on personal income and spending at 8:30 a.m.

And then the Federal Reserve will release its Beige Book for October at 2 p.m.

India's gross domestic product grew by 7.3% in the quarter ended September. That's a slight increase from the previous quarter and much stronger than China's 6.7%.

That means India is still the fastest growing major economy in the world. But a cash crunch could mean growth slows sharply in coming quarters.

6. Coming this week:

Wednesday - OPEC meeting

Thursday - Auto sales

Friday - U.S. jobs report