1. Stocks near 2016 highs: It's the final trading day of 2016.

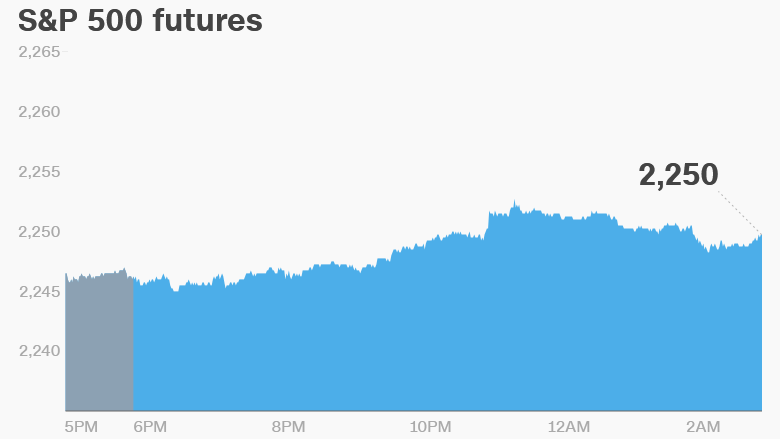

U.S. stock futures are rising again, giving the Dow Jones industrial average one more shot at hitting the coveted 20,000 point level before the year ends.

The Dow has been flirting with the 20,000 mark for weeks and reached its highest ever level -- 19,988 -- on December 20. It's currently sitting at 19,820, which is nearly 14% higher than where it started 2016.

The S&P 500 and Nasdaq are also just a touch below their all time records.

The S&P 500 has run up by 10% and the Nasdaq has rallied by 8.5% since the start of the year.

2. Global market overview: European markets look set to end the year with a whimper. They're dipping lower in early trading.

Russian stock markets are mixed after President Barack Obama sanctioned a number of Russian individuals and entities and ordered 35 Russian diplomats to leave the country. The White House took the retaliatory step over Russia's alleged interference in the 2016 election.

It's worth noting that Russian stock markets were among the best performing in the world this year. Investors expect President-elect Donald Trump will thaw frosty U.S. relations with Russia.

Looking to Asia, the markets are closing the day with mixed results.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Italian banks find support: Italian bank stocks have been holding steady after the European Commission extended a program to support liquidity at the banks.

"This means that regardless of circumstances banks will have no difficulties in funding their operations and deposit access will be ensured at all times," a Commission spokesperson said in a written statement.

Investors have been concerned about Italy's struggling banking sector, which has been burdened by high levels of bad debts. Monte dei Paschi -- the weakest of the bunch -- is negotiating a government bailout.

4. Toshiba rebounds: Shares in Toshiba (TOSYY) have posted a 9.4% rebound in Japan following a massive drop this week that had erased $6.6 billion from the tech giant's market capitalization.

Investors hit the sell button after the company warned it would soon report billions in losses related to the takeover of a nuclear business in 2015.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Friday - U.S. bond market set to close at 2 p.m.