1. The end of Yahoo: Verizon's $4.5 billion purchase of Yahoo is expected to close Tuesday, ending Yahoo's more than two decades as an independent company.

Yahoo (YHOO) and AOL will team up as a new digital company inside Verizon (VZ) called Oath. Verizon expects to cut as many as 2,100 employees after the combination.

2. Fed meeting kicks off: The Federal Open Market Committee kicks off a two-day meeting on Tuesday. The central bank is expected to announce an interest rate hike on Wednesday.

It would be the third rate hike in seven months. Higher rates reflect the Fed's confidence in an economy that has recovered well from the Great Recession.

3. Uber fallout: Uber will announce recommendations Tuesday from an investigation into sexual harassment and workplace culture at the startup.

There have been reports that top officials, including Uber's CTO and one of its board members, might be put under the microscope.

The company announced Monday that Emil Michael, Uber's chief business officer and right-hand man of CEO Travis Kalanick, has left the company.

4. U.K. government talks: Prime Minister Theresa May is meeting with leaders of the Democratic Unionist Party (DUP) on Tuesday.

May needs the fringe party's support in order to form a government after her party lost its parliamentary majority in last week's election shocker.

May needs to move quickly: Brexit negotiations are set to begin on Monday, although they could be delayed because of the uncertain political environment in the U.K.

The pound climbed 0.3% against the dollar to $1.27 on Tuesday, recovering some of the ground lost in the wake of the election.

The currency has lost 15% of its value since the Brexit referendum, contributing to a rise in prices. Inflation surged to a four-year high of 2.9% in May, according to data published Tuesday.

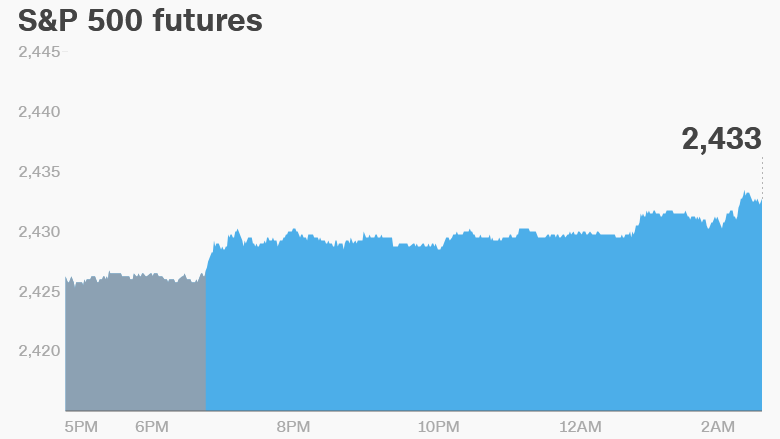

5. Global market overview: U.S. stock futures were higher early Tuesday.

European markets opened higher, while Asian markets ended the session with gains.

The Dow Jones industrial average closed 0.2% lower on Monday, while the S&P 500 shed 0.1%. The Nasdaq declined 0.5%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

6. Earnings and economics: H & R Block (HRB) is set to report earnings after the close.

The U.S. Bureau of Labor Statistics will release its inflation report for May at 8:30 a.m. ET.

OPEC will publish its monthly report.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Tuesday -- Fed meeting begins; Verizon/Yahoo deal set to close; Attorney General Jeff Session's testifies before Senate; Uber releases report into sexual harassment allegations; U.K. inflation data

Wednesday -- Fed interest rates announcement; U.S. inflation data; U.S. retail sales data; Crude inventories report; Marijuana industry conference; U.K. jobs report

Thursday -- U.S. initial jobless claims; Manufacturing output and industrial production data; Bank of England rate decision; Kroger (KR) releases earnings Friday -- U.S. housing market data; University of Michigan's consumer sentiment index