1. Deutsche Bank overhaul: Germany's biggest lender is retreating from Wall Street.

Christian Sewing, who has been CEO for less than a month, announced a major overhaul on Thursday that will see the bank scale back its operations in the United States and Asia and review its global equities business.

Germany's largest bank also announced "painful" jobs cuts in its investment bank after its net profit fell by 79% to €120 million ($146 million) in the first quarter.

"Even a quick look at the figures makes one thing clear: we have to take action -- fast," Sewing said. "There is no time to lose as the current returns for our shareholders are not acceptable."

Sewing replaced John Cryan as CEO earlier this month after the bank posted three consecutive annual losses.

2. ECB meeting: The European Central Bank will announce an interest rate decision at 7:45 a.m. ET, followed by a press conference at 8:30 a.m.

Analysts expect the rate policy to remain unchanged.

But the bank may give more insight on whether weak economic data could delay the gradual end of its stimulus program. The ECB has purchased bonds worth over €2 trillion ($2.5 trillion) as part of the effort.

3. What scandal?: Facebook's shares jumped as much as 7% in extended trading after the company reported it has 1.45 billion daily active users and 2.2 billion monthly users, both of which were up 13% over the previous year.

Facebook (FB) posted nearly $12 billion in revenue for the first three months of 2018, up nearly 50% from the same period a year earlier.

The audience gains were revealed as part of Facebook's first earnings report since the Cambridge Analytica data scandal surfaced last month and shaved tens of billions off its market value.

On a conference call with analysts, Zuckerberg stressed that he remains committed to the advertising business model that has powered Facebook.

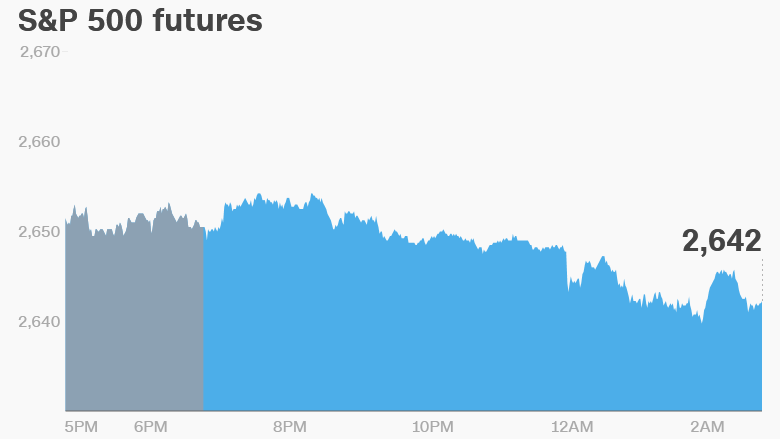

4. Global market overview: US stock futures were mixed, reflecting a broader trend across global markets.

European and Asian markets struggled to find direction -- stocks in the United Kingdom and China were lower, while the rest of Europe, Japan and Korea posted gains.

The Dow Jones industrial average gained 0.3% on Wednesday, snapping the longest losing streak in a year. The S&P 500 jumped 0.2%.

The Nasdaq shed 0.1%, dropping for the fifth day in row and extending its longest losing streak since just before President Donald Trump's election.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: It's another busy day for corporate earnings.

American Airlines (AAL), Bristol-Myers (BMY), ConocoPhillips (COP), Domino's Pizza (DPZ), Dunkin' Brands (DNKN), Fiat Chrysler (FCAU), General Motors (GM), Hershey Foods (HSY), Hilton (HLT), Nokia (NOK), PepsiCo (PEP), Royal Caribbean (RCL), Southwest Air (LUV), Spirit Airlines (SAVE), Time Warner (TWX), Union Pacific (UNP) and UPS (UPS) will publish earnings before the open. Time Warner is the parent company of CNN.

Amazon (AMZN), Baidu.com (BIDU), Ellie Mae (ELLI), Ethan Allen (ETH), Expedia (EXPE), Intel (INTC), Mattel (MAT), Microsoft (MSFT), Starbucks (SBUX), and U.S. Steel (X) will follow after the close.

The US Department of Labor will release its weekly data on initial unemployment claims at 8:30 a.m. Advanced goods trade balance data for March will be published by the Census Bureau at the same time.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Thursday — Time Warner, American Airlines, Dunkin' Brands, General Motors, PepsiCo, Starbucks and Southwest earnings

Friday — Exxon earnings; Q1 GDP