1. More trade threats: The White House is threatening even more tariffs on China.

President Donald Trump said he would impose tariffs on an additional $200 billion worth of Chinese goods if Beijing goes through with its promise to retaliate against the US tariffs announced on Friday.

China responded to the latest threat by accusing the United States of "extreme pressure and extortionist behavior," warning it would "strike back hard."

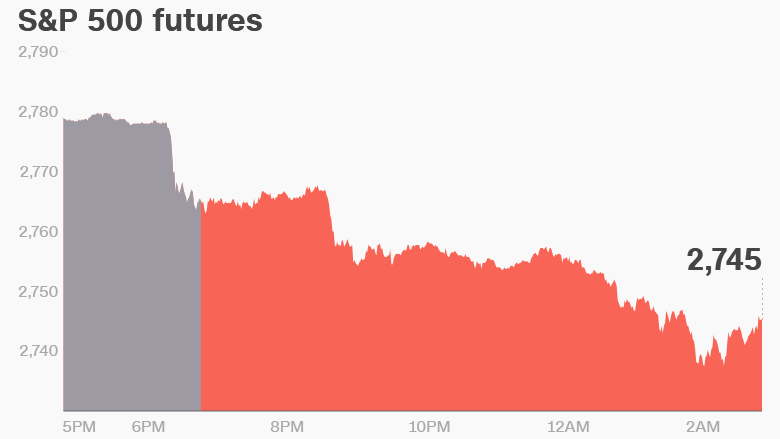

2. Markets dip in response: Investors reacted negatively to the latest round of confrontation between the United States and China, the world's two largest economies.

US stock futures were down.

Asian markets ended the session sharply lower. Stocks declined by 3.8% in Shanghai and 2.8% in Hong Kong. Benchmark indexes in Seoul and Tokyo dropped by 1.5% and 1.7%.

European markets also opened in the red. Stocks in London and Paris shed roughly 1%, while the Dax declined 1.7% in Frankfurt.

3. Volkswagen in trouble: Shares in Volkswagen (VLKAF) dropped 2.5% on Tuesday as investors continued to react to the arrest of Rupert Stadler, the CEO of its Audi (AUDVF) subsidiary.

Stadler was arrested Monday as part of an investigation by Munich prosecutors into emissions cheating. Volkswagen (VLKAF) has been embroiled in the diesel emission cheating scandal since 2015 and has paid billions in fines on both sides of the Atlantic.

3. ZTE plunges: Shares in Chinese tech firm ZTE (ZTCOF) plummeted more than 25% after US lawmakers sought to uphold a ban that prevents the company from buying crucial American parts.

The Hong Kong-listed stock of ZTE, which makes smartphones and telecommunications equipment, had already been hammered last week when it resumed trading for the first time in nearly two months.

5. Monday market recap: The Dow Jones industrial average closed 0.4% lower on Monday, while the S&P 500 shed 0.2%. The Nasdaq was flat.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

6. Earnings and economics: FedEx (FDX), La-Z-Boy (LZB) and Oracle (ORCL) will release earnings after the close.

The US Census Bureau will publish its May housing starts report at 8:30 a.m. ET.

The British pound has dropped to its lowest level against the dollar in seven months after the UK government lost a key Brexit vote in the upper house of parliament. The currency shed 0.4% to trade at $1.31.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

7. Coming this week:

Tuesday — FedEx (FDX) earnings

Wednesday — American Outdoor Brands (AOBC) earnings; Senate Finance Committee tariff hearing

Thursday — Darden (DRI), Kroger (KR) earnings; bank stress test results

Friday — OPEC meeting