1. China volatility: The yuan is having a very rough July.

The Chinese currency dropped to its lowest level against the US dollar in nearly a year on Tuesday, before staging a recovery that wiped away its losses for the day.

Investors have two big worries: China's economy appears to be stumbling, and trade tensions between Beijing and Washington continue to escalate.

The Trump administration moved Monday to block state-owned Chinese wireless carrier China Mobile (CHL) from linking up with the US market, citing national security concerns. On Friday, the United States will level tariffs on about $50 billion worth of Chinese imports.

2. Glencore tumbles: Shares in Glencore (GLCNF) dropped 10.5% after the mining and commodities company said it had received a subpoena from the US Department of Justice.

US authorities are seeking documents related to compliance with money laundering and anti-corruption laws, according to Glencore. The requested documents relate to its operations in Nigeria, the Democratic Republic of Congo and Venezuela.

Glencore said in a statement that it was reviewing the subpoena.

3. Emerging market pain: The Turkish lira dropped almost 1% against the dollar after data showed inflation reached 15.4% in June.

That's a sharp increase from the 12.2% rate posted in May, and three times the central bank's target of 5%. Stocks opened flat in Istanbul.

A growing number of emerging markets are coming under pressure over fears that a trade war could hurt global economic growth. Moody's warned last week that Turkey is among the countries most vulnerable to a stronger dollar.

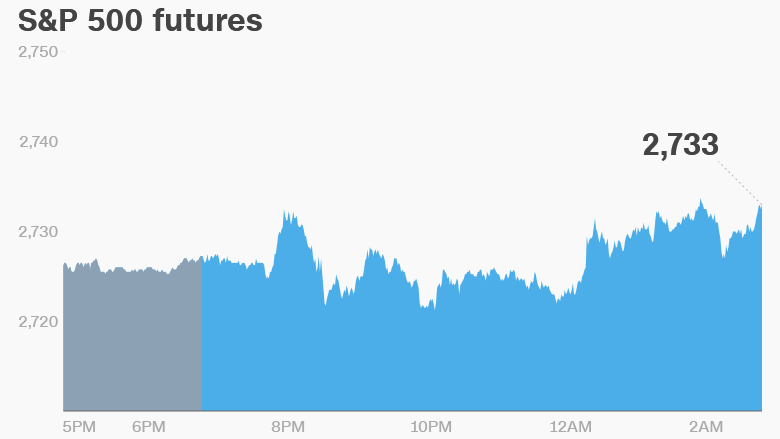

4. Global market overview: US stock futures were higher ahead of a shortened trading session.

European markets were higher. Shares in Germany gained 0.6% after Chancellor Angela Merkel struck a deal with her interior minister on immigration policy that keeps her government intact.

Stocks in Asia ended mixed.

The Dow Jones industrial average closed 0.2% higher on Monday, while the S&P 500 was up 0.3% and the Nasdaq gained 0.8%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Companies and economics: A report on US auto sales for June will be published at 2:00 p.m. ET.

Shares in HTC dropped 6.7% in Taipei after the Taiwanese smartphone manufacturer announced it was laying off 1,500 people after years of losing money and market share.

The Reserve Bank of Australia left its key interest rate at 1.5% for the 23 month in row.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Tuesday — American automakers report June sales; US markets close early

Wednesday — US markets are closed for Independence Day

Thursday — US Federal Reserve reports its Board of Governors meeting minutes

Friday — US jobs report; tariffs on the first $34 billion of Chinese goods go into effect