1. The trade war is on: The United States and China have imposed steep new tariffs on tens of billions of dollars of each other's exports.

US tariffs of 25% are targeting more than 800 Chinese products worth $34 billion such as industrial machinery, medical devices and auto parts. They kicked in just after midnight ET.

Beijing immediately responded with tariffs on over 500 US products including SUVs, meat and seafood. It accused the United States of starting "the biggest trade war in economic history."

"China is forced to strike back to safeguard core national interests and the interests of its people," the country's Commerce Ministry said in a statement.

2. US jobs report: The US economy added 213,000 jobs in June, according to the Labor Department. It was another strong month of gains, after 223,000 jobs were created in May.

Economists had predicted 195,000 jobs.

The unemployment rate ticked up to 4% as more people entered the labor force looking for work. That's up from the 3.8% rate recorded in May.

"The jump in the unemployment rate, at this stage, is not too alarming, and actually helps to explain why wages haven't been surging," said Kathleen Brooks, research director at Capital Index.

3. Brexit crunch time: British Prime Minister Theresa May has convened a government summit that's billed as her last chance to unite her party and produce a plan for Brexit.

Britain is set to leave the European Union in just nine months, but businesses still don't know whether they will be able to continue to export goods to the European Union without border checks or tariffs.

Several major companies have warned they might have to leave or scale back their operations in the United Kingdom if a trade deal is not agreed.

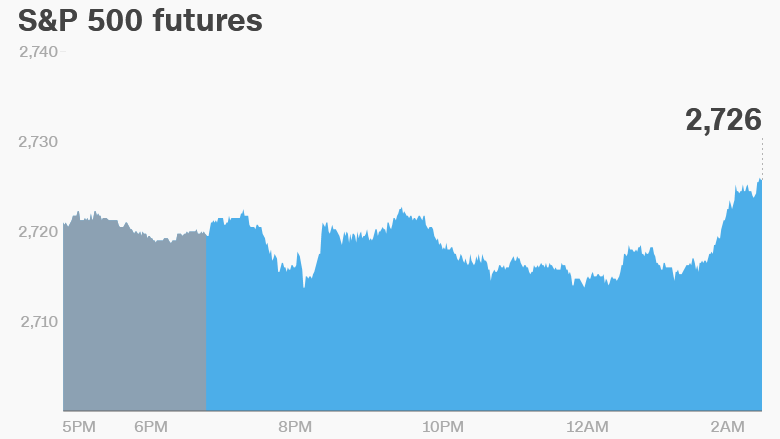

4. Global markets overview: US stock futures were in positive territory.

European markets opened higher, following a positive trading session in Asia. The US dollar dropped slightly against a basket of major currencies.

"The rumor was sold and the news is being bought, with the dollar the softest of the G10 currencies overnight," said Kit Juckes, a strategist at Societe Generale.

The Dow closed 0.8% higher on Thursday and the S&P 500 added 0.9%. The Nasdaq was flat.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Companies and economics: Samsung (SSNLF) said Friday that its operating profit for the quarter ended June is expected to come in at 14.8 trillion won ($13.2 billion), down from the previous quarter's 15.6 trillion won ($14 billion).

That results marks the end of a year-long streak of record quarterly earnings by the world's biggest smartphone maker. Samsung's shares dropped 2.3%.

Shares in German conglomerate Thyssenkrupp (TKAMY) jumped 3.7% after CEO Heinrich Hiesinger announced his resignation. Hiesinger was under increasing pressure from shareholders over his plans for the future of the group.

German industrial data for May came in way above expectations. It could be a sign that an earlier slowdown was fleeting.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Friday — US jobs report; tariffs on the first $34 billion of Chinese goods go into effect