1. Xiaomi's IPO: Xiaomi made a bumpy stock market debut on Monday.

Shares in the Chinese smartphone maker sank as much as 5.9% from their listing price, which was already at the bottom of the range the company had sought.

They steadied later in the day but still closed down 1.2% at 16.80 Hong Kong dollars ($2.14). The broader Hong Kong market was up around 1.5%.

Xiaomi raised $4.7 billion from its IPO, which valued the company at about $54 billion — much less than it was reportedly hoping for earlier this year.

Related: Xiaomi's IPO flop: Shares fall in Hong Kong debut

2. China's Spotify to go public: Tencent (TCEHY), one of China's biggest tech companies, said in a statement Sunday that it was planning to list its music streaming business in the United States.

It didn't provide a time line or details on the size of the proposed stock offering, but recent reports have suggested an IPO could value Tencent Music at more than $30 billion, putting it on a par with Spotify (SPOT).

Related: China's Tencent turns to US for IPO of its music business

3. Chinese rebound: China's main stock exchange in Shanghai had the best day in two years on Monday, closing 2.5% higher. The yuan also posted gains, trading 0.3% higher against the dollar.

Chinese markets have had a rough few months, as investors worry about the intensifying trade war with the United States.

4. Brexit chaos: Britain's top Brexit negotiator has resigned from Prime Minister Theresa May's government in protest at her vision for the country's exit from the European Union.

The resignation of David Davis deals a big blow to May, and comes just two days after the government agreed a new "business friendly" plan for Brexit.

The United Kingdom is set to leave the European Union in just nine months, but it still hasn't agreed the terms of its exit or the framework for a new trade deal with the rest of the bloc.

The pound held steady despite the drama, trading at $1.33. The main stock market in London opened higher.

Related: UK offers new 'business-friendly' plan for Brexit

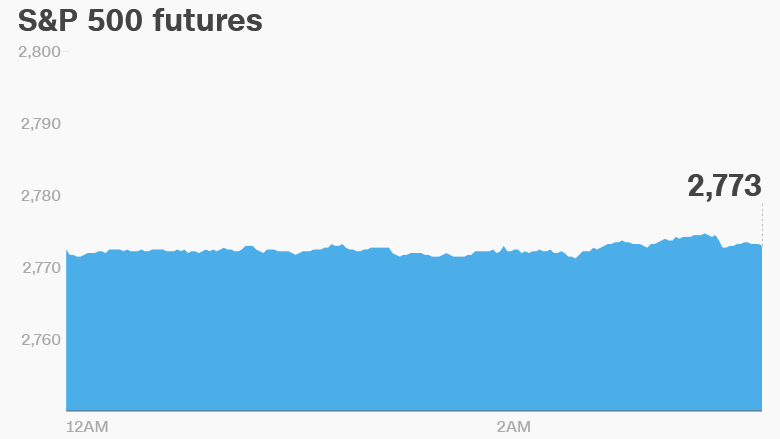

5. Global market overview: US stock futures were pointing higher early on Monday.

European markets opened up, following a positive session in Asia.

The Dow Jones industrial average gained 0.4% on Friday after the US jobs report shows solid employment gains but disappointing wage growth. The S&P 500 was 0.9% higher and the Nasdaq was up 1.3%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

6. Companies and economics: Shares in Nissan (NSANF) dropped 4.5% in Tokyo after the company said it would make an announcement on its procedures for measuring emissions in Japan.

In a statement after the market close, Nissan said most of its Japanese plants produced inspection reports that contained falsified measurements on exhaust emissions and fuel economy. It said it has since confirmed that all vehicles except for its GT-R sports car still meet Japanese standards.

German exports grew more than imports in May, widening the trade surplus of Europe's biggest economy.

Mexican inflation data for June will be released at 9 a.m. ET.

The Federal Reserve will release its consumer credit report at 3 p.m. ET.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

7. Coming this week:

Monday — Xiaomi IPO

Tuesday — Pepsi earnings

Wednesday — Producer Price Index

Thursday — Delta earnings; Consumer Price Index

Friday — Citi, JPMorgan, PNC, Wells Fargo, First Republic Bank (FRC) earnings; Consumer sentiment index